THE Minerals Council South Africa (MCSA) tried to strike a diplomatic stance when it launched its 2026 State of Mining Report, which traditionally kicks off the Mining Indaba in Cape Town. It described 2025 as a year in which South African mining “experienced both challenges and progress”.

But apart from the absence of load-shedding by Eskom and a slow recovery in Transnet’s performance the progress part of the ledger looks thin, with the balance again tilted towards the challenges that are continuing to hold back the mining sector.

In his foreword to the report MCSA, CEO Mzila Mthenjane paints a far more realistic picture of the economic context in which the industry operates: “South Africa remains globally uncompetitive with regards to electricity prices, constrained rail and port operations, and significant shortcomings in water infrastructure.

“We must address persistent domestic constraints in the form of electricity tariffs, regulatory hurdles and infrastructure limitations to unlock the industry’s full potential. We have a long way to go to restore the fundamental services needed for a thriving economy that attracts sustainable, long-term capital investments,” he writes.

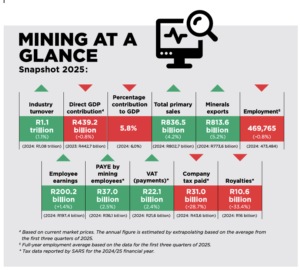

The generally gloomy picture is also reflected in some of the preliminary 2025 economic statistics for the industry: The mining sector’s direct economic contribution at R439bn was just below the R442bn recorded in 2024. As a result, its contribution to the South African economy is set to decline from 6% in 2024 to 5.8% in 2025 and employment in the sector is expected to shrink by 0.8% to around 470,000 employees.

Amid rising precious metal prices export earning last year were steady at R1.93 trillion, as the risk of the US volatile tariff regime is described as “low to moderate”. South African mineral exports continued to benefit from strong demand in its key markets, namely China, India and the US.

The traditional detail on government’s mining regulations (or lack thereof) is missing from the report. That is largely because, following on the earlier draft release of a revised Mineral Resources Development Bill, government has been rather silent on the legislation. But Mthenjane stressed at the release of the report: “We trust the next version of the bill will reflect the extensive engagements with the DMPR to create laws that will encourage and sustain investment and growth in our industry,” he writes.

The report focused extensively on the impact of the surging Eskom tariffs on the sector describing it as the industry’s “major competitiveness issue”. Its acting chief economist Bongani Motsa says there has been a 970% increase in tariffs between 2007 – 2024 with further 8% a year tariff hikes likely this year and in 2027.

MCSA President Paul Dunne said at the launch of the report that it was not surprising that renewable electricity generation in the mining industry is accelerating and taking significant business away from Eskom.

Transnet reform

The positive impact of co-operation between mining companies and Transnet was highlighted by the fact that Transnet’s volume of coal, iron ore and chrome freight picked up to 171 million tons last year from the low of 150Mt in 2022/23. Mthenjane called on Transnet to continue the reforms to the rail network and opening up transport corridors to private sector operators, which has stalled recently.

The MCSA devoted significant time on outlining the impact of the constraint on the sector, particularly on mining exploration. South Africa used to account for 5% of global exploration spend in the early 2000s, says its acting chief economist Bongani Motsa. “Now it’s about 0.6% with expenditure on mineral exploration only R781m in 2025 compared to R6.2bn in 2006,” he says.

The MCSA lists the usual impediments that prevent a pick-up in spending: the implementation of the new mining cadastre, lack of exploration incentives and continued uncertainty around future mining regulations. It is therefore unlikely, says the MCSA, that the current multi-year commodity boom will reflect in significant new investment in the South Africa mining sector in years to come.