LUCAPA Diamond Company raised $10m through a share issue with the proceeds primarily to be directed to the $8.5m expansion of its Mothae mine in Lesotho.

Investors will subscribe for about 181.2 million Lucapa shares at an issue price of $0.055 per share, representing a discount of 10% to the firm’s volume weighted average price during the previous five-day period. The issue also attaches options of $0.08 per share which expire after two years.

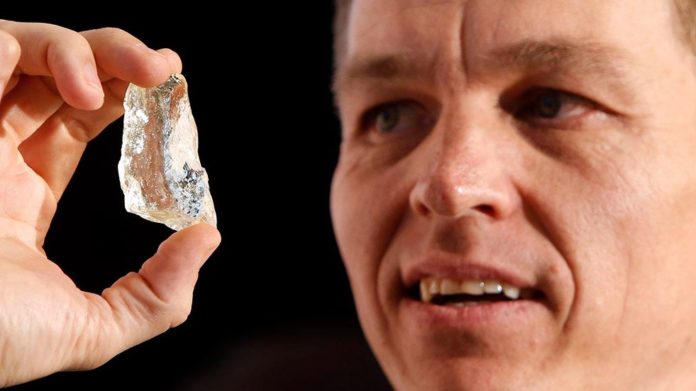

Stephen Wetherall, CEO of Lucapa Diamond, said he was “extremely pleased” to have placed the shares which were largely supported by a private investor in Ilwella Ltd, the investment vehicle of the Flannery family office, and Safdico International, a subsidiary of famed diamond jeweller, Graf International.

The expansion of Mothae will involve improving processing capacity at the mine some 45% to 1.6 million tons a year. “This should materially increase production, revenues and due to economies of scale, improve unit operating costs and deliver improvements to earnings,” said Lucapa in a statement.

“The Mothae expansion should see a material increase in the benefits derived by the Basotho nation and to our shareholders,” said Wetherall. The balance of the cash raised would be used for working capital purposes.

Lucapa said in October it had re-opened Mothae mine following a six month Covid-19 induced hiatus. This would enable Lucapa to deliver into its new marketing channel announced in September. In terms of the agreement, Lucapa will sell its goods directly to diamantaires, and participate in the margins of the polished goods.

In April, Lucapa sold 3,963 carats from the mine into the partnership achieving an average price of $505 per carat.