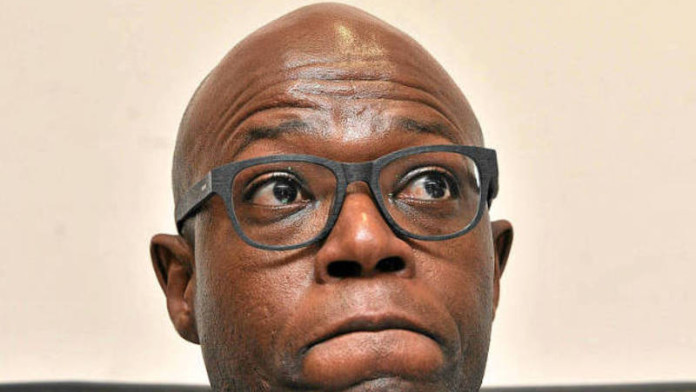

ESKOM interim CEO, Matshela Koko, took a hard line stance with coal suppliers Exxaro Resources and Anglo American saying at the utility’s quarter update today that neither would restructure without its input.

He even suggested that instead of restructuring its black economic empowerment (BEE) component down to 30%, Exxaro should instead create a joint venture with Eskom in which employees of the mining firm were shareholders.

“When it comes to Anglo, we will not be difficult but what belongs to us, belongs to us. It [restructuring of the firm’s coal interests] will never happen without us,” he said.

Koko’s references are to changes in the ownership or structure of both mining firms. In the case of Exxaro, it announced last year it intended to lower its BEE shareholding to 30% from 50% held previously after the conclusion of the firm’s former, 10-year BEE contract.

Anglo American is selling its domestic coal mines in terms of a board strategic divestment of its non-core assets that also currently involves shares in Kumba Iron Ore.

According to Bloomberg News, Anglo has lined up a shortlist of three bidders for its domestic coal mines – chairman of Richards Bay Coal Terminal, Mike Teke, MTN’s Phuthuma Nhleko and Sandile Zungu of Zungu Investments. Anglo said discussions with Eskom and the South African government continued which suggests that the sale of the mines still had some road to run.

But Koko reserved most of his outspoken comments for Exxaro saying that its decision to restructure its BEE shares without consulting Eskom was “a slap in the face”.

“We made a board decision to invest R1.8bn in Matla [a mine Exxaro manages] so there is more coal after 2023 when the current coal contract expires,” said Koko. “We did this to support black mining and so that Exxaro could compete with South32 and Anglo. To read that it is reducing its shareholding to 30% after what we have done is a slap in the face; after what we’ve paid for the assets.”

“I think Exxaro should set up a joint venture with employees as shareholders. It is a radical idea,” he said. Koko said earlier that his personal views were sometimes confused with those of Eskom’s.

There has been agreement between Exxaro and Eskom on liability for rehabilitation charges at the Arnot mine which Exxaro shut in December 2015 after it failed to renew a coal sales agreement (CSA) with Eskom.

Koko said that as the mine belonged to Eskom – this was disputed for a time – it was responsible for rehabilitation, but it would only compensate Exxaro for the rehabilitation on a stage-by-stage basis.

Commenting on Anglo American, Koko said: “I have met with Anglo and said: ‘You will not restructure without our input'”, adding that there was no disagreement with Eskom’s former contention that it owned some of the mine’s assets having paid for their construction in the past.

“There is no disagreement on ownership and, therefore, we have entitlement [to assets in Anglo’s domestic coal mines]. We will decide on what to do with them,” he said.

TEGETA

Agreement was also outstanding with Tegeta Exploration & Resources, a company owned by Oakbay Investments which is a Gupta family company, following its request in November to withdraw from a CSA with Eskom’s power stations.

Koko said that were Tegeta to be released from its CSAs it had to ensure that it did not raise Eskom’s primary energy costs or result in losses.

Tegeta supplies about 7.7% of Eskom’s total coal supply requirements including a CSA between its Brakfontein and Brakfontein Extension mines to Eskom’s Majuba power station in South Africa’s Mpumalanga province.

It has also supplied Eskom’s Hendrina and Arnot power stations from Optimum Coal Mine which it bought out of business rescue for R2.15bn earlier last year. Optimum’s Hendrina contract ends in 2018 whereas supply to Arnot power station was a stop gap after Eskom declined to renew the coal contract with Exxaro Resources.

“We continue to have discussions with Tegeta; they are difficult because we have a contract. In the same way we were difficult with Glencore, we will do the same,” he said. Glencore was the former owner of Optimum Coal Mine prior to it going into business rescue following a breakdown in contract talks with Eskom.

“If we decide to shake hands Eskom must not lose money or effect the bottom line. We will insist that Eskom remains cost neutral,” he said. “They are saying to us that the contracts are a political nightmare for both of us, and given the report [State of Capture] is it not proper that we shake hands and go our different ways?”

“If I were in their shoes, I’d do the same,” he said.