[miningmx.com] – ROYAL Bafokeng Platinum (RBPlat) made light of the first six months of 2014 posting a 33% in share earnings on the back of a weaker rand against the dollar which added R220m to the bottom line.

The outcome was a 45% increase in headline share earnings, but including shares issued in terms of a R1.5bn rights call, earnings per share came in at 116c/share. In line with the capital-heavy profile of RBPlat’s growth plans, no dividend was declared.

“Our stable share price is proof of our commitment to shareholder growth,” said Steve Phiri, CEO of RBPlat. “Overall, we are confident of a good 2014,” he said.

RBPlat’s performance is at odds with most of the South African platinum sector which saw earnings and cash flow shredded from January to June amid a five-and-a-half month strike by the Association of Mineworkers & Construction Union over wages.

Phiri acknowledged, however, RBPlat was not entirely unaffected by the strike activity which he calculated had lopped total industry production 1.5 million ounces.

“Employees were initially unsettled at BRPM (Bafokeng Rasimone Platinum Mine) … ” which had resulted in a spate of accidents including breaking of an acetylene bottle at the group’s Styldrift project affecting seven days of work.

“It would have been naive to think our employees were not looking over their shoulders, although no lives were lost,” said Phiri. “We were relieved we went through the period relatively unscathed,” he said.

South African platinum production would fall to around three million ounces this year compared to 4.17 million oz, he said.

Production at BRPM came in some 3% higher in the six months ended June 30 to 86,400 ounces for which RBPlat received 15% more per ounce on average as the rand fell to 10.70 against the dollar compared to 9.30 in the previous six months.

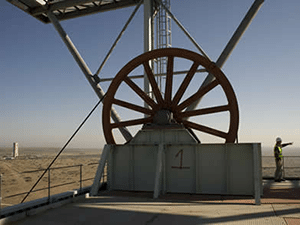

The rest of RBPlat is predominantly about the progress and financing of its capital plans which include the R1.29bn Merensky replacement and a R116.5m chairlift projects at BRPM, and the mammoth R10.5bn Styldrift project.

Martin Prinsloo, CFO of RBPlat, said the company had dispensed with a R1bn revolving credit facility which would save the company R600,000 per month in commitment fees, preferring instead to raise R2.5bn to R3bn in term debt in the first half of the 2015 financial year “… at the earliest”.

Once completed the Styldrift project would add 300,000 of 4E platinum group metals, more than doubling the 280,000 4E PGMs currently produced at BRPM. A prefeasibility for a Styldrift II expansion was due to be completed this year.

There are some exogenous factors affecting RBPlat in the medium term including a court date with the South African Revenue Service (SARS) which is now not allowing for the deduction of shareholder loans from 2008 to 2010 and totalling R437.5m.

Phiri said the company had made no provision for the amount as this would be tantamount to acknowledging liability. “We have got good prospects of success,” said Phiri of the dispute with SARS.

RBPlat is also exposed to the cash flow problems of Shaft Sinkers which is conducting work for the platinum firm on its Styldrift project. “I hope they don’t go bust tomorrow,” said Phiri. “It would be disruptive,” he said.

Contingency plans, such as taking over supplier contracts, had been agreed with Shaft Sinkers and were it to be liquidated the potential disruption to Styldrift would not extend to more than a month, said Phiri.