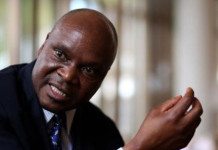

[miningmx.com] – LONMIN was cash flow positive after capital expenditure owing to the depreciation of the rand, cost-cutting and the slight improvement in the dollar price of the platinum price, said the group’s CEO, Ben Magara.

“I never thought I would celebrate $920/oz platinum price but at the exchange rate, Lonmin is cash flow positive after capex,” said Ben Magara. The platinum price was at about $850/oz at the beginning of 2015.

“We are marginally positive. Not all of that is from the rand, but the rand has been helpful. As for the platinum price, it has moved up from $824 to $920/oz. One swallow does not make a summer, but the signs are good,” he said.

Analysts believed that based on the firm’s December quarter operating figures, Lonmin had negative free cash flow of an estimated $120m of which about $100m was related to a pipeline restock which would be subsequently unwound.

Magara also said that all 6,000 of the planned retrenchments, as set down in a restructuring last year, had been completed. “All 6,000 gone and finished without any industrial action. It was tough, but think it was crucial to save the goose,” he said.

In December, Lonmin completed a $400m rights offer based on a new business plan in which it would reverse losses, even at the current dollar platinum price lows of the time. The offer was not well supported, however.

Analsyts were critical of Lonmin’s efforts to stay alive saying that its business plan was not likely to succeed. In the end, South Africa’s state-owned pension, the Public Investment Corporation underwrote part of the issue taking its stake in the platinum business to 29.99%.

Magara was equally critical of the people who thought the company should simply go into liquidation. “Do they think that shareholders can force a company to stop operating,” he said of the fact that Lonmin’s lenders were always likely to step in and save the company. Lonmin employed about 34,000 people prior to its restructuring.

Magara said there was no change to production forecast for the year of 700,000 oz of platinum group metals and capital expenditure of about $132m.