[miningmx.com] – Lonmin shares closed nearly 6% higher at 615c on the JSE on Wednesday after rising to as high as 641c as investors reacted favourably to the trading update and details of the revised business plan and funding strategy for the next three financial years.

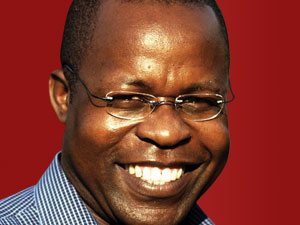

Full details of the $400m rights issue to be held will be announced on November 9 according to Lonmin CEO Ben Magara.

Key point is that the shares have held onto most of the gains made since Lonmin bottomed at 306c at the end of September before clawing its way back to just over 800c on October 9.

According to JP Morgan Cazenove analysts Allan Cooke and Abhishek Tiwari the trading update for the financial year to September 2015 was “better than we’d expected with net debt of $185m at year-end compared to $282m at the end of the first half of 2015′

The analysts added that Lonmin “has proposed a $400m rights issue that, together with the amended debt facilities of $370m (until 2020) should be more than sufficient to see it weather current low platinum group metal prices, in our view.’

Despite this – and despite Lonmin management’s plans to remove “high cost production ounces’ in order to improve cash flow and profitability – the JP Morgan analysts believe higher platinum group metal (pgm) prices will be required over the next three years if Lonmin is to achieve break-even on its free cash flows.

They describe the business and funding plans unveiled by Lonmin as “encouraging’ but point out that, “we estimate a spot basket price for Lonmin at R10,930/oz 6E (six element pgm) currently.

“Given management’s guidance for flat unit costs of production at around R10,340/oz6E we estimate that the group’s EBITDA (earnings before interest, tax, depreciation and amortisation) is around 5% before special items – mainly the R800m restructuring costs.

“The group’s free cash flow margin remains negative to the tune of R676/oz6E; R557/oz6E and R1,372/oz6E in financial years 2016, 2017 and 2018 respectively should spot metal prices and the rand/dollar exchange rate persist.

“So higher pgm prices are required in the ensuing three years for the group to achieve free cash flow break-even, in our numbers.’