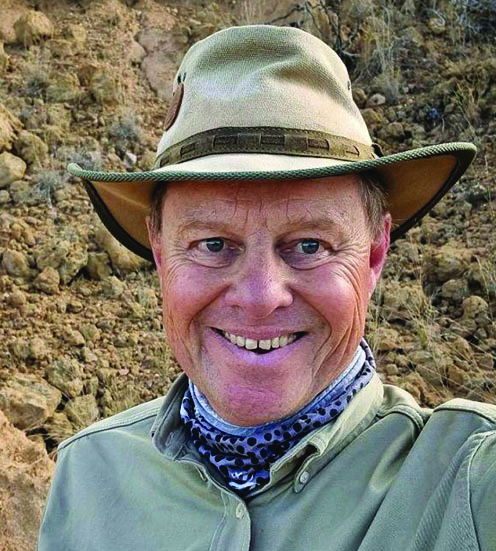

Michael Scherb

FOUNDER & CEO: Appian Capital Advisory

‘The wall of money needed to build metal supply for the energy transition cannot be raised by mining companies alone’

THE wall of money needed to build metal supply for the energy transition, estimated by Bloomberg NEF to be $307 trillion, cannot be raised by mining companies alone. Enter private equity, which has found a willing partner in the Western governments. With geopolitics running hot, they have mobilised their balance sheets in the interests of mineral security as never before.

Last year, Appian Capital secured a $1bn partnership with the International Finance Corporation (IFC), the World Bank’s commercial arm, for mining projects in Africa and Latin America. The initial focus of funds will be on the underground development of Santa Rita, a nickel mine in Brazil that Appian manages. It was the aborted sale of this mine and another, a copper mine called Serrote (sold to China’s Baiyin Nonferrous in April for $420m), that formed the basis of a four-year legal fight with Sibanye-Stillwater, the latter claiming that material adverse events supported its decision to pull out of the $1bn+ deal. The UK’s High Court didn’t agree but before the parties convened in November to award damages, Appian agreed a $215m settlement with Sibanye-Stillwater.

Appian’s business, however, is not about winning court cases but providing equity or streaming-linked finance. Unsurprisingly, gold formed a major part of these efforts last year. In August, it supplied $175m in finance to Asante Gold’s efforts to build Ghana production. As the year drew to a close, Appian backed Atlantic Group’s $305m purchase of Tongon mine in Côte d’Ivoire from Barrick Mining. In another development, Appian’s head of global affairs, Dominic Raab, the UK’s former deputy prime minister, said the company was in talks with the US and Australia about replicating the partnership with the IFC. “We think that the IFC formula is very attractive,” said Raab.

LIFE OF MICHAEL

Born in Taiwan, Scherb became a citizen of the world early in his life after attending schools in seven countries across Asia, Europe and the US. He started work in Beijing structuring foreign debt before joining JP Morgan’s metals and mining team in London. He founded Appian at a tender 29 years in 2011, quickly establishing a reach that sees him spend around 200 days a year travelling. Out of work his passion is sport, any sport: hence Scherb is a follower of basketball’s Cincinnati Bearcats, Ohio State football and West Ham United, a London football club.