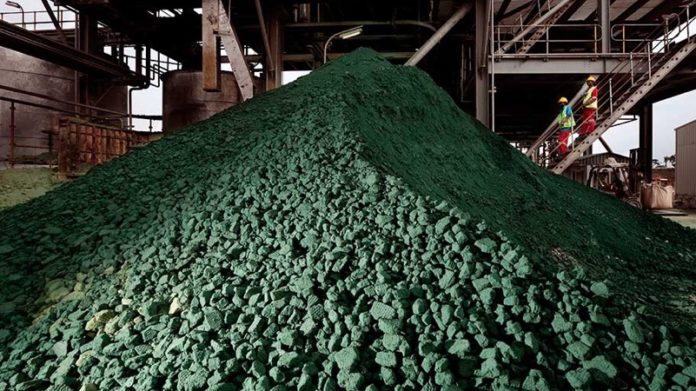

CHINESE cobalt smelters remain well-supplied despite a four-month export ban imposed by the Democratic Republic of Congo in February, said Reuters which cited industry sources at this week’s Cobalt Congress 2025 in Singapore.

“Large-scale users in China are sitting on six months of stocks,” said Shirley Wang, GM at Shanghai Metals Market, during Thursday’s session. “Though small-scale companies, with half a month stocks, will have to buy from the spot market at higher prices.”

Congo’s ban, implemented to address global oversupply and revive slumping prices, has successfully driven cobalt to approximately $16 per pound, up from $10 at the end of 2024, said Reuters. The battery metal is crucial for electric vehicles and mobile phones.

According to Wang, Chinese traders have accumulated cobalt metal reserves equivalent to 12 months of demand.

Congo’s mines minister, Kizito Pakabomba, acknowledged in an interview at the event that the ban has had limited impact on consumers. “Our ban is to make sure that at the end of the day, supply meets demand, but we have noticed that supply has not been affected to consumers,” Pakabomba said.

Patrick Luabeya, head of Congo’s regulatory agency for mineral substances, indicated on Wednesday that the country might implement stricter cobalt controls when the current export ban expires.

Market analysts project persistent oversupply for the foreseeable future. Wang forecasts total 2025 supply will increase 6% to 327,000 tons, while demand will grow just 0.3% to 237,000 tons. This imbalance is expected to continue through 2030, with projected supply reaching 390,000 tons against demand of 264,000 tons.