THE irony of the government’s proposed chrome tax, aimed at encouraging local beneficiation of minerals, is that it punishes companies that do most to beneficiate.

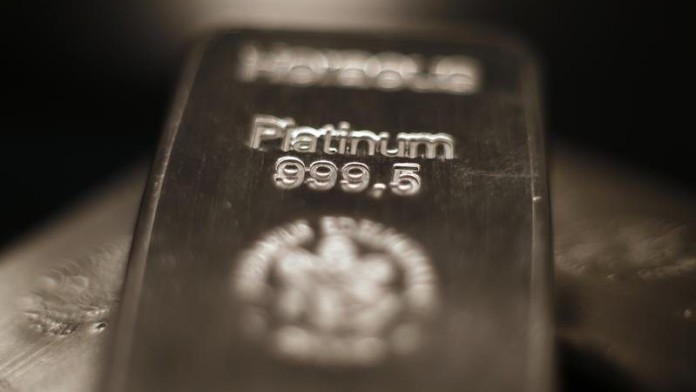

Platinum is refined to a purity level of 99.95% before it is exported from South Africa. Yet the metal’s miners face a reported 25% levy on chrome byproducts that occur naturally with platinum group metals (PGMs).

If that sounds like madness, consider the plight of the lesser lights of the PGM industry such as Tharisa. It recently unveiled plans to bring forward $547m in investment over the next decade at its North West platinum/chrome mine. Half of its PGM concentrate is refined in South Africa. It also beneficiates its chrome ore into metallurgical, chemical and foundry-grade concentrates, as well as for the stainless steel industry, at its site in Brits.

Ilja Graulich, head of investor relations, is unsure if Tharisa’s chrome production will attract the proposed tax, or indeed an export quota mooted by mineral & petroleum resources minister Gwede Mantashe earlier this month as an alternative means of encouragement.

Uncertainty is the last thing South Africa’s mining sector needs, especially because foreign and local investors are already so sensitive to mining cost inflation. When Tharisa announced its expenditure plans, shares in the company fell. Graulich said, however, the capital is for the migration of operations to underground that will take production to two million tons of chrome concentrate and two million ounces of PGMs, a target Tharisa had sought previously from its open-pit operations without quite getting there.

Going underground also gives Tharisa more flexibility to produce a ‘cleaner’ ore, meaning less dilution, Tharisa CEO Phoevos Pouroulis said in an investor presentation earlier this month. As for the capital layout, peak funding will be $173m, at the most. On an annual basis, the outlay is $70m-$90m, which is not unlike current stay-in-business capital, which Graulich said would be a good way of viewing its expansion plans.

Despite their initial shock, analysts have warmed to Tharisa’s plans, especially when it was pointed out that the transition to underground will kick in fully only in 2036. Output for the foreseeable future will be from the open-pit mines.

Given the strength of PGM prices (particularly platinum), this peak point may well be reduced and brought forward, said Peter Mallin-Jones, an analyst at UK investment bank Peel Hunt. Annual average spend of $67m “looks affordable compared to our estimated operating cash flow of $155m for the 2026 financial year”, he added.

The concerns about balance sheet pressure are because Tharisa already has major production growth commitments elsewhere in its portfolio. “The market may question how comfortable Tharisa feels balancing capital commitments for its ongoing Karo project in Zimbabwe concurrently with the underground mine,” said Richard Hatch, an analyst at investment bank Berenberg in London.

Tharisa unveiled the Karo project in 2022, initially scoping a $250m outlay before increasing the capital cost to $391m, partially owing to delays. Last year, Karo was put on hold as the decline in PGM prices dimmed its chances; lenders were understandably cautious. But now the project is back on the investment radar. If built, Tharisa’s Karo will add about 400,000 oz in annual PGMs. For an industry desperate to find new ounces, the project will be a major boost, especially for Zimbabwe, which has rolled out the red carpet.

Graulich said the project will be financed in a standalone structure, separate from the Tharisa mine in South Africa. About half of the finance has been secured by Tharisa. The balance, about $190m, will either be through the introduction of a strategic partner or a streaming deal, effectively the same in the sense that both are equity.

Nedbank Securities analyst Arnold van Graan said: “Though we expect the market to react negatively to the capex numbers and funding obligations in the short term, the benefits of the project should support the longer-term valuation, especially in an environment of rising PGM prices.”

Mallin-Jones added: “We continue to favour Tharisa for its broadly consistent operations and attractive blend of both PGM and chrome revenues.”

Shares in Tharisa have rerated this year, along with many PGM stocks, gaining 45% to just under £1 in London. But analysts believed it could go higher. Berenberg has a target price of £2 a share.

“Tharisa’s low-cost, long-life operation appears cheap,” added Mallin-Jones. “Rising PGM prices highlight the tight supply situation as Tharisa secures its long-term, low-cost future,” he said.

A version of this article first appeared in the Financial Mail.