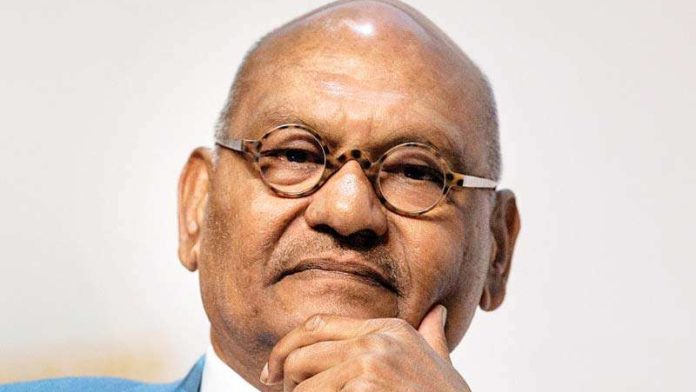

MINING mogul Anil Agarwal has taken a more direct role in the affairs of Vedanta Zinc International’s (VZI’s) $400m Gamsberg development after taking on the role of chairman of the local subsidiary company.

Announcing a management restructuring today, Vedanta said Agarwal will chair Black Mountain Mining (BMM). He is joined by VZI’s CFO, Pushpender Singla, who will be a board director. “Vedanta is fully committed to expansion of our operations in South Africa,” said Agarwal in a statement.

“I am looking forward to contributing to this growth journey in partnership with the South African government and to be part of the larger vision that will continue to bring prosperity and transformation in the Northern Cape,” he said.

Former VZI CEO, Deshnee Naidoo, expressed concerns about how the business environment in South Africa could negatively affect the feasibility of expanding Gamsberg. The mine will produce 250,000 tons per year of zinc concentrate, but if the next two phases are completed, production would ramp up to 600,000 tons per year.

“We need speedy decisions on issues like power, infrastructure and fiscal stability,” said Naidoo in November last year. “Without certainty on these issues, investors will be reluctant to commit to projects that might take a long time to show a return on investment. The risk is simply too great”.

Naidoo resigned from VZI in May saying she wanted to spend more time with her family. Her departure was two months after Vedanta CEO, Srinivasan Venkatakrishnan surprisingly quit the firm.

Vassi Naidoo, chairman of South Africa’s Nedbank Group and previously CEO of Deloitte Southern Africa, will also join the BBM board whilst Abiel Mngomezulu, a former CEO of Mintek, will become an executive member on BBM’s advisory committee.

Agarwal has a bullish view on southern Africa’s mining sector and during the time he was a 19% shareholder in Anglo American, via his family investment firm, he urged the UK-listed group to make more of its presence on the continent.

“Gamsberg will be a catalyst in South Africa,” he said in 2017. “We are entrepreneurs and there are some risks we have to take. But the South African government and people have opened their arms. We don’t get moved from pillar to post for approvals and South Africa operates by the rules.”