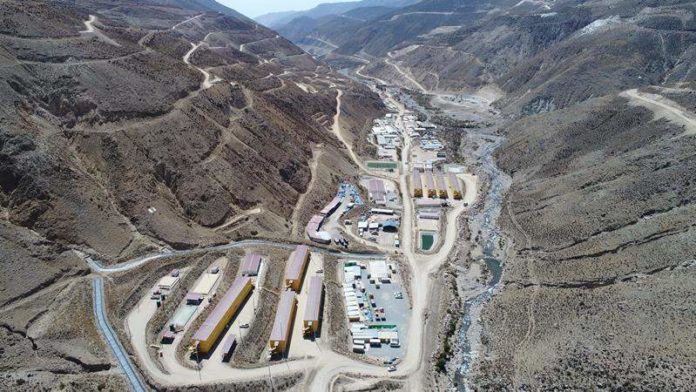

ANGLO American has produced first copper concentrate from Quellaveco, its $5.3bn project in Peru held in joint venture with Mitsubishi – an important precursor ahead of receiving final regulatory clearance for commercial operations to begin.

“This first production of copper concentrate marks the beginning of the normal period of testing the processing plant with ore and the ramping up of mining activities to demonstrate readiness for operations,” said Tom McCulley, project leader for Quellaveco.

The project is being delivered on time and budget despite two years of downtime suffered as a result of the Covid-19 global pandemic.

Once in production, Quellaveco will increase Peru’s copper production about 10% and create 2,500 direct jobs as well as other economic benefits related to procurement and an increase in water for human consumption.

However, first production from the project comes at a time when the price of copper has weakened 20% year-on-year and 26% in the last quarter. It is currently trading at about $7,572 per ton, down from $7,795/t the previous day.

Goldman Sachs said in a report today there had been minimal disruption to its expected supply deficit amid continued demand for the metal. The price weakness was related to macro-economic factors, however.

“We view the majority of copper’s recent downside as down to macro financial flows, best characterised by rapid dollar appreciation, as compared to our initial expectation for a stable dollar and a continued risk-on macro environment,” it said.

The copper market would be in a narrower deficit than previously expected – now forecast to be about 119,000 tons – followed by a balanced market in 2023 with a deficit of only 17,000 tons against previous expectations of a 120,000 ton deficit.