THE current year to end-February 2025 will be make or break for junior miner Copper 360 which has reported poor financial and production performances in its first set of results since listing on the JSE last April.

The copper miner, which is exploiting dump reserves and old underground mines around Nababeep in the Northern Cape, saw its production hammered by a series of problems including loadshedding, a “critical” mill failure and the impact of having “inadequate crushing capacity”.

Operations were also hit by poor recoveries which necessitated a three month stoppage of the SX/EW plant so that a cyclone circuit could be installed to improve copper recoveries.

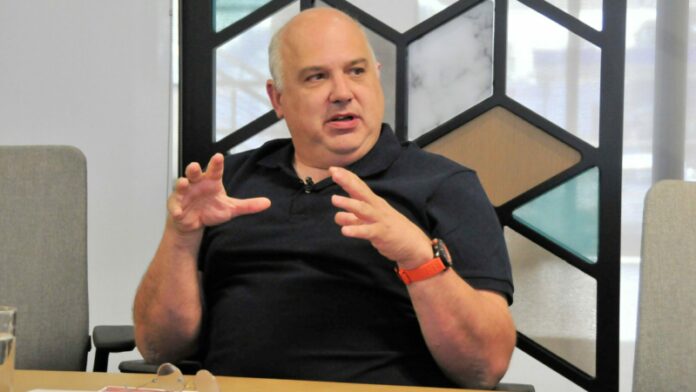

CEO Jan Nelson has put a brave face on the situation declaring in the results statement – and on an investor webcast held today that – “… this year was never about driving profitability and increasing the margin.

“It was about listing, securing the capital to build the Rietberg Copper mine, establishing copper concentrate processing capacity, and ensuring operational improvement at the SX/EW operation.

“The company achieved all these objectives and has laid the foundation to deliver significant returns for the coming year starting on 29 February 2024”.

Nelson’s problem is that his company’s performance has fallen horribly short of the forecasts made in the pre-listing statement (PLS) published early last year. The PLS forecast revenues of R462.5m but actual revenues amounted to only R38m. The PLS also forecast an operating profit of R244.8m instead of which an operating loss of R129m was made.

The PLS also stated the SX/EW cathode operation and the soon-to-be commissioned slag-to-copper concentrate project “is producing copper cathodes on a consistent basis and is ramping up to steady state production.

“The experienced COCC (Cape Copper Oxide, a subsidiary of Copper 360) has proven its capabilities and is poised to grow the business successfully.”

That simply did not happen and the plant produced only 313.5 tons of copper for the year against PLS forecasts of 100t/month at steady state operation – which should have been achieved in March 2023.

On top of that should have come production from the first copper concentrate MFP1 plant, but completion of the plant was delayed for six months after Nelson opted to buy the nearby Nama Copper operation for R200m. Copper 360 did not have funds to do both.

According to Nelson both plants – SX/EW and the Nama plant – are generating profits at present with a third plant, the delayed MFP1, due to kick in from August. The means 2024 is shaping up to be a game changer for the company, good or bad.

Nelson bets R40m in own shares

Nelson commented: “Our timing could not be more perfect to deliver copper production in a rising copper demand and price environment”. He is forecasting copper production for the current financial year at between 6,500 and 10,000 tons and he better be right for his own sake as well as that of the shareholders.

The PLS revealed that – to help secure its participation – Nelson had struck a private agreement to sell 10 million of his own Copper 360 shares to 15% backer, the Ekapa Consortium at a price of one cent each “in the event that Copper 360 produces less that 7,740 tons of copper over the period of date of listing to February 28, 2025”.

On current share prices that means Nelson has some R40m odd riding on the block backing his optimism over Copper 360’s performance this year.

It seems that, so far, shareholders are buying into Nelson’s story because the share price is holding up well at levels around 400 cents/share despite an initial dip from around 440c/share last week when these results were published.