THE Democratic Republic of Congo’s decision to suspend exports of under-pressure cobalt for three months in February was unlikely to yield positive results, said the Financial Times.

Commenting on the industry, the newspaper said it was difficult for Congo to enforce the export suspension as its borders were porous, especially amid conflict with neighbour Rwanda.

Secondly, even assuming more policy of its borders, the Congo faces new competition from from Canada which is increasing copper output from which cobalt is a by-product. Indonesia also produces cobalt as a by-product of nickel.

On the demand side, technologies are changing, said the Financial Times.

“Car manufacturers are starting to switch from nickel manganese cobalt batteries to cobalt-free lithium-iron-phosphate (LFP) batteries, which have longer life cycles and fewer environmental issues,” it said.

While LFP batteries had less power adoption will continue as technology improves. “That suggests the picture will not change much for DR Congo,” said the paper.

“History shows those doing the extracting typically win when it comes to tussles over resources. Extractivism has had a long history in the global south; that is one thing technology has done nothing to change,” it said.

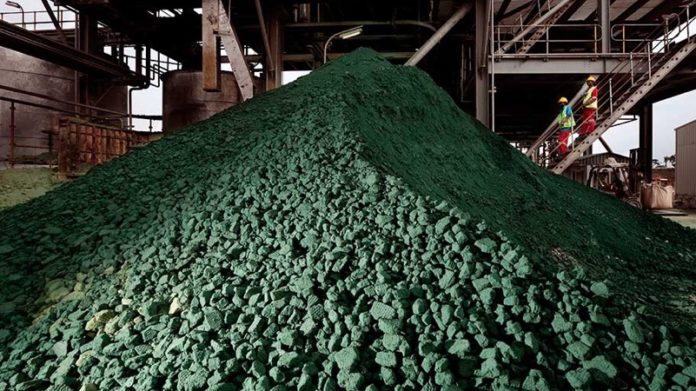

Congo produces about three-quarters of the world supply of cobalt which soared in recent years. This invited new producers into the industry, principally China’s CMOC Group which ramped up output at two large mines in the Congo, causing supply to outpace demand and prices to tumble.

Since imposing its three month ban, the Congolese government has suggested it may introduce cobalt export quotas to curb oversupply and boost prices. However, no final decision has been made, according to reports.