GLENCORE said it hadn’t yet signed a contract addendum with Transnet Freight Rail (TFR) for coal exports on the rail line to Richards Bay Coal Terminal (RBCT).

The group added that most other major South African coal exporters had taken a similar watch-and-wait position in terms of negotiations with the government-owned utility.

“We remain in discussion,” Murray Houston, CEO of Glencore Coal South Africa told media during the group’s half year results presentation on Thursday. “There are a number of outstanding things about which we are not in agreement,” he said.

“To the best of our knowledge none of the other shareholding parties have agreed to it and they remain in discussion.” Smaller coal exporters operating in the Quattro system, developed to facilitate exports of new entrants through RBCT had signed with TFR.

In April, TFR issued a force majeure with coal exporters using RBCT because of its “inability to perform services at its stated system capacity”. It ripped up the take-or-pay agreements with exporters with a view to renegotiating new terms.

Exxaro Resources, another major coal exporter, said at the time it didn’t believe the reasons for the force majeure were valid. TFR said recently that all but one coal exporter was back on board with new export allocation agreements.

Maintenance upgrade?

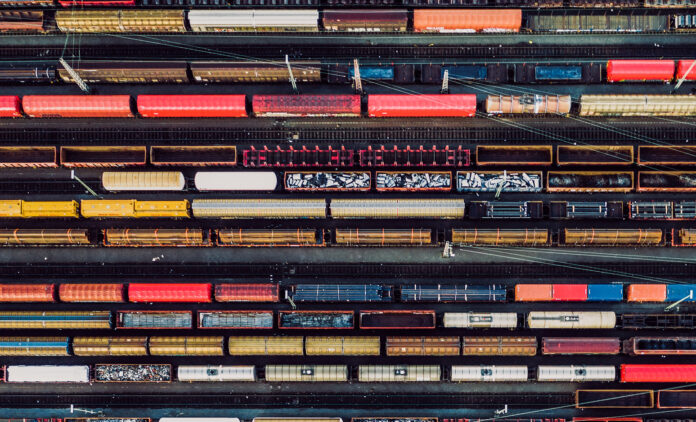

Houston said it was likely that for the year TRF would deliver between 55 million to 60 million tons (Mt) through RBCT, well off the 68-72Mt level TFR achieved several years ago. A combination of cable theft, possible contractor corruption, and an inability to procure spare parts for locomotives has been cited by TFR for the problems.

Sizakele Mzimela, CEO of TFR said that following a 10-day maintenance shutdown in late July, several network improvements had been made. These improvements included four additional train slots with a further four more due in September. About 36 kilometres of line on the coal network had also been replaced, she said.

Houston said so far he was yet to notice the improvement.

“We are waiting for reports on what exactly was completed,” he said. “The initial three days has not shown significant improvement.”

Graham Wanblad, CEO of Anglo American, told Miningmx last week that he feared the true cost of TFR’s operating problems was yet to be counted. A level of private public partnership was critical, he added.

Houston said opportunities for private investment on the rail network were limited during a so-called ‘bridging’ period when TFR was attempting to restore stability on the line – up to about 2024. There may be potential to work with TFR in a second phase of investment after that date, however.

“Discussions for the period after March 2024 are due to start,” said Houston. “We have not started in detail. Some concepts do seem to envisage some private investment,” he said. “There is nothing concrete at this time.”

Mzimela said last week – in reference to the current bridging period – there was little opportunity for private investment. “There are many opportunities here and there to bring in private participation but it is very unlikely it will be on the main line. I have to be honest about that,” she said.