BUSHVELD Minerals cut its vanadium production target for this year owing to problems at its Vametco plant near South Africa’s North West province town Brits.

Production will come in between 3,700 to 3,900 tons compared to a previous estimate of 4,500 tons at the higher end of its range.

Shares in the company sank to a new five-year low on the London Stock Exchange. Bushveld Minerals is currently capitalised at £30.9m.

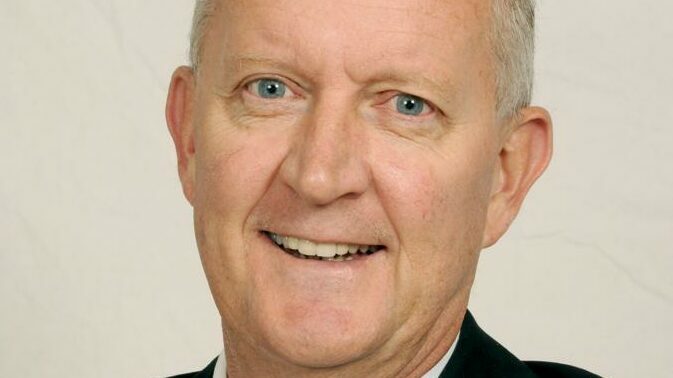

Newly appointed CEO Craig Coltman said in a second quarter and interim operational update today with “after careful review … the 2023 production outlook needs to be revised”. The problems at Vametco – which produces a pelletised version of vanadium – included levels of the barren dam and the sulphate recovery plant.

Vanchem, facilities near Emalahleni in Mpumalanga province, also had “a weak first half performance,” said Coltman. He added, however, there were opportunities for a turnaround in the second half of the firm’s financial year.

“In my short time at the company, I have seen that, while there are challenges, there are also many positive signs and opportunities to get the most out of Bushveld’s most important assets,” he said.

He added that a review of the group’s capital allocation strategy and priortisation of projects would form part of his review.

Bushveld has been through the wringer in the last few months culminating in the departure of its founding CEO, Fortune Mojapelo on June 21. It seems his resignation was a precursor to finalising the recapitalisation of Bushveld’s balance sheet – which is yet to be completed.

This relates to refinancing of a $45m convertible loan note (including interest) with Orion Mine Finance which is part of a $65m financing package arranged in 2020.

Bushveld reported $24m in impairment losses for its 2022 financial year of which $17.2m in impairments related to Vanchem. The group had previously recognised a $60m gain on the bargain purchase on the acquisition of Vanchem in 2019.

The outcome of the impairments was an adjusted earnings before interest, tax, depreciation and amortisation loss of $1.7m for the 12 months ended December. This compares to an adjusted EBITDA loss of $9.9m for the previous year.

For the 2022 financial year, Bushveld reported a $35.4m net loss (2021: -$34m). Cash and cash equivalents fell to $10.9m as of December 31 compared to $15m at the close of the previous financial year. Net debt increased to $79.5m (2021: $68.9m).