SOUTH African president Cyril Ramaphosa’s Reconstruction and Recovery Plan, presented to Parliament on Thursday, did not go far enough articulating how foreign investor interest in the country could be rekindled, said the Minerals Council South Africa.

Whilst capturing a number of the agreed points from the Nedlac (National Economic Development and Labour Council) discussions, it was short on detailing institutional reform and how the private sector could participate in areas such as infrastructure, rail, and port development, the council said.

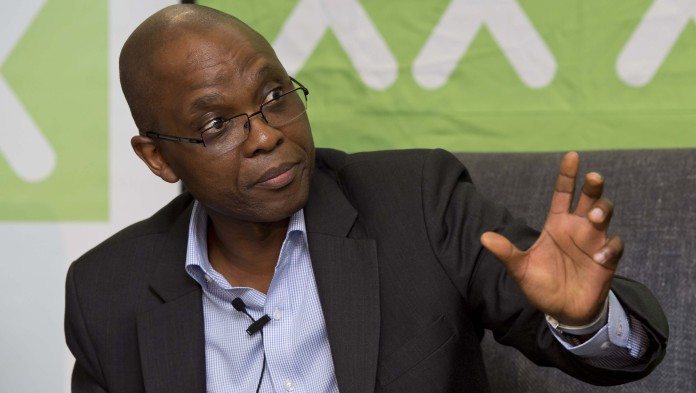

“The South African economy was in a crisis before the outbreak of the Covid-19 pandemic, performing well below its potential for the past decade,” said Mxolisi Mgojo, president of the Minerals Council.

“Covid-19 has further exacerbated the situation resulting in 2.2 million South Africans losing their livelihoods during the second quarter of 2020, with the country’s fiscal deficit ballooning to 15% of GDP and GDP likely to shrink by 9%,” he said.

The plan does not adequately address in detail the issues that drive competitiveness and investment, including foreign investment, the council said. “The tough choices on structural reforms that would allow much greater private sector participation and investment are mostly absent or are only mentioned in passing,” it said.

Roger Baxter, CEO of the Minerals Council, said that with the “right interventions” the South African mining sector could comprise 3% of global exploration spend (compared to 1% today) and contribute significantly to GDP growth.

“It is critical that we have a frank conversation on the real structural and institutional issues impeding competitiveness and growth at the national level and to develop detailed plans on how to unlock these constraints,” he said.