[miningmx.com] – IMPALA Platinum (Implats) may be forced to consider another round of fund-raising, quite possibly a rights issue, in less than two years if the platinum price slump persists, said BMO Capital Markets.

Edward Sterck, an analyst for BMO, said in a report dated January 13 that Implats faced a “funding shortfall” at both its price forecasts and at the spot market price which on the day the report was issued was $839,44 per ounce. Platinum is currently trading at $822/oz – a 35% decline in 12 months.

BMO has modelled Implats on a dollar platinum price forecast of $864/oz in 2016 rising to $938/oz and $975/oz in 2017 and 2018 respectively. However, its rand assumptions seem benign at 14.1 to the dollar for this year and 14.4 and 13.4 in 2017 and 2018. The rand is currently trading at 16.78 to the dollar.

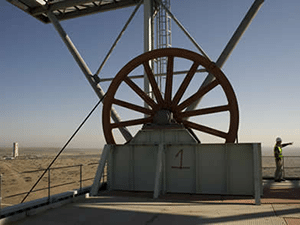

Implats raised R4bn in a rights issue in October and would invest R4.5bn over the next three years in its new generation shafts at Lease Area in Rustenburg. The company was expected to be free cash flow negative over the next two years, said Sterck.

Whilst the company could fund itself for two years, Sterck warned that the balance sheet concerns might re-emerge after a year as R5.8bn in convertible bonds was due in February 2018.

Said Sterck: ” … we forecast a significant funding shortfall on both our base price estimates and at current spot prices. As such, if PGM prices remain lower for longer, the company may be forced into expensive refinancing alternatives such as a deeply discounted rights issue,” he said.

The risks for Implats, and the South African platinum industry in general, boil down to the likely performance of dollar metal prices.

According to RMB Morgan Stanley analyst, Christopher Nicholson, the platinum price was close to the bottom of the cycle, however, low prices at these levels may be maintained for a while into the future.

A stronger US dollar, a slowing in platinum automotive demand growth to 3% from 5%, and a low risk of significant producer supply cuts would keep platinum subdued.

“Against this backdrop we argue that while current depressed margins (CY15 sector EBITDA margin 12% vs 33% long term) now appear to be close to the bottom of the cycle this may well be an extended bottom,” he said.

Merrill Lynch agreed that platinum price bottoming out would be a strung out process. “We expect platinum to continue bottoming out, although this may be a long and drawn-out process,” it said in a report.