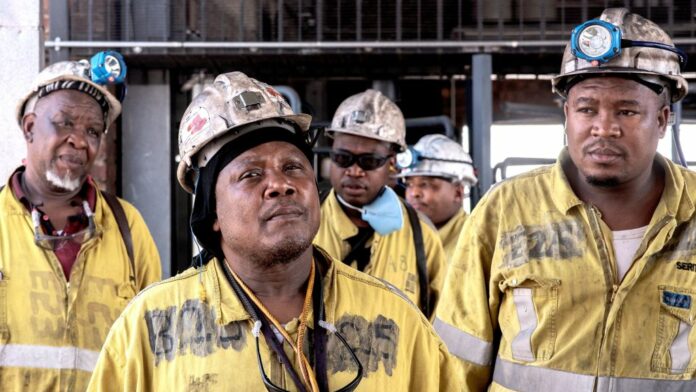

SIBANYE-Stillwater is to retrench 852 full time employees and contractors at its South African platinum group metals (PGM) mines, it announced on Friday.

This follows the conclusion of Section 189 negotiations held in terms of the Labour Relations Act with unions and other affected parties. Sibanye-Stillwater said in October up to 4,905 employees were potentially affected by restructuring in the face of steep PGM price declines.

Sibanye-Stillwater said it would close its mined out Simunye shaft while the Rowland and Siphumelele shafts at Marikana section have been “repositioned”. All in all 47 full time employees and 805 contractors will be retrenched with a further 1,281 employees granted voluntary separation or early retirement packages.

Natural attrition between the start of Section 189 negotiations and today’s announcement accounted for 467 less retrenched employees. A total of 351 employees accepted transfers to other shafts to fill these vacancies.

Other retrenchments could follow as the miner agreed to keep a marginal shaft, known as 4B, open provided there were no net losses on a monthly basis. This shaft, which is also part of Sibanye-Stillwater’s Marikana operations, has 1,496 employees and 54 contractors. “Should this not be sustained and subject to certain conditions the shaft will be closed,” said Sibanye-Stillwater.

The expectation at the end of 2023 was that PGM prices had probably bottomed out. However, the basket price (platinum, palladium and rhodium) has fallen under renewed pressure averaging nearly 3% less compared to the basket’s January 2 average.

Other retrenchments may in the works for Sibanye-Stillwater. The group, which is due to report its full year numbers on March 5, has yet to comment on additional restructuring at Stillwater, it’s US palladium-dominant mine.

It’s been a chastening time for Sibanye-Stillwater. In November it cut 287 employees at Stillwater mine followed by 575 employees at its gold operations in South Africa in December. It may also announce the closure of its Sandouville nickel refinery in France after saying in January its feasibility was threatened by a decline in the metal’s price last year.

On February 21, Sibanye-Stillwater said in a trading statement that the carrying value of assets had fallen by $2.58bn (R47.5bn) for the 12 months ended December.

“Despite delivering within 2023 production guidance, the US PGM operations and the Sandouville refinery will require further repositioning to address losses which are impacting group profitability and considering the depressed commodity price environment, have contributed to significant impairments being recognised,” said Sibanye-Stillwater CEO Neal Froneman at the time.

South Africa’s PGM sector is under huge stress. On February 19, Anglo American Platinum announced restructuring potentially putting 3,700 permanent jobs at risk as well as people employed at 620 companies contracting to the group.

Impala Platinum, which said last year it was looking to cut jobs, is due to report its half-year numbers on February 29. Earlier this month it impaired assets for R1.69bn and said basic interim earnings would be between 86% and 93% lower.