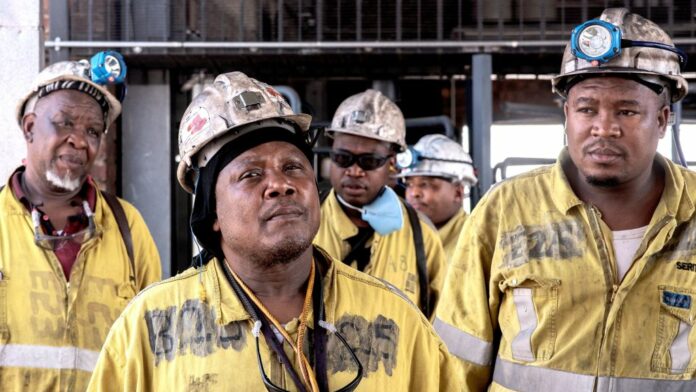

SIBANYE-Stillwater announced further restructuring of its South African business potentially affecting 3,107 employees and 915 contractors.

The reduction in headcount will be at operations and at its regional head office where employee numbers were surplus to current and future activities, the group said in an announcement on Thursday.

Neal Froneman CEO of Sibanye-Stillwater said on Wednesday at the PGM Day, a conference in Johannesburg that “we will always look at the overhead structure and potentially there is some restructuring at central (head office)”.

The operational restructuring was at its gold operations including Beatrix 1 shaft which had been unable to deliver on planned production and Kloof 2 plant which had insufficient feed to cover overheads following the closure of Kloof 4 shaft in 2023.

Restructuring would also take place at the Burnstone after deciding to defer the capital development of the Mpumalanga province gold project last year.

Commenting on proposed head office restructuring the group said it plans were to realign regional services, shared service and direct services structures “to align with the requirements of the reduced operational footprint”.

“This will reduce direct operational services costs and regional overhead costs which are allocated to the operations, thereby contributing to the sustainability of the South African region,” it added.

In a sound file published, Sibanye-Stillwater head of corporate affairs James Wellsted said that of the 3,107 jobs potentially affected 1,794 could be “reduced”. Subject to consultations, the final jobs lost could be lower, he added.

Sibanye-Stillwater announced R6.5bn worth of restructuring last year of which about half were at its US palladium and platinum mine Stillwater. The group called time on a proposed expansion of Stillwater to 700,000 ounces a year of palladium and platinum. Production for 2024 is expected to be between 440,000 to 460,000 oz.

The firm’s South African PGM mines were “cash flow positive”. Sibanye-Stillwater had “moved very early to take out lossmaking production”, said Froneman on Wednesday. He added that Stillwater was making progress after cutting back production targets.

According to a report by RMB Morgan Stanley, published on March 13, mines owned by Sibanye-Stillwater, Impala Platinum (Implats) and Northam Platinum’s Eland project could burn about $430m in cash, after stay-in-business expenses, by calendar year-end.

Said Froneman: “The good news is we are Ebitda positive at Stillwater. We are not cash flow positive, but we won’t close it. If you think taking out 400,000 ounces (in annual PGM production) out of the market … no, it’s not happening. It’s too strategic”.