[miningmx.com] – THE most frequently asked question about gold shares nowadays is: “should I buy “shares’ or bullion’? From 1895 to 2006 this question never arose: you bought gold “shares’ dummy. (Why buy the bottle – when you can own the whole store?).

The attraction of gold shares in the past was that the capital value of the gold index usually kept up with the gold price and the shares averaged close to a 8% dividend every year as well. So that was good money considering that inflation (US) averaged about 3% a year those 110 years.

So what happened after 2005 that caused this wonderful relationship to all of a sudden fall apart? Why, since the beginning of 2006, has the gold price beaten our Gold Index by a factor of 9 times?! That’s right: not by 9% or 90% . But by 9 times!

Has management “really’ been that bad? Have the unions “really’ been responsible for this 110-year relationship to completely fall apart? Or is it government that is responsible?

Managers are employed the world over in every possible type of company or sphere to look after the owners best interest. Managers are specifically employed to protect the owner’s wealth, their business: their assets. And for pretty much constantly from 1895 – 2006 that was the case.

Managers, though far from being overpaid in most cases, performed their task remarkably and consistently well. But since 2006 the wheels have definitely come off. Big Time too! And what makes this huge under-performance even “more’ baffling is the fact that the rand gold price has actually done pretty well since 2006.

So why were gold shares able to beat the gold price for 110 years? And then from 2006 they underperformed by 90%? That’s right. By 90% including dividend payments! And in just 8 years too.

Now if this was the IT industry one could possibly understand that kind of under-performance. What with the price of one’s product falling constantly (literally “by the day’.) What with new competitors popping up daily – with better more exotic devices at ever falling prices. One can almost understand why some IT businesses go bust. But a whole industry underperforming it’s “product’ – by 90% over 8 years? Come on. What is happening?

Even more baffling is – the price of the “product’ i.e. gold/Krugerand, from 1960 thru 2013, rose an average of 12.5% pa. Yet the South African Gold Index still beat this 12.6% a year total return hands down until 2006.

So is it more useful to ask why gold shares did so well from 1895 – 2005? Or to ask why they have done so badly the past 8 years (2006 – 2013). And which trend is likely to persevere for the rest of this year and over the next 2, 3, 5 and 10 years?

Obviously there must be powerful reasons for this huge under-performance of late: grades, working costs, unions, government, suppliers, mine depth, environmental and yes – maybe even “management’ deserves some of the blame.

But shouldn’t the 20% a year rise in the rand gold price since 2006 counter “some’ of these problems out – if not most of them?

As stated earlier, management is paid to take the blame, the responsibility, whether it’s their direct fault or not. They are “paid’ to be the “responsible’ party. The “accountable’ party. Maybe even the “fall guy’?

Management is “paid’ to figure out and implement the solution. To deliver the objective. That is why they live in the big house “on top of the hill’ and the rest of us live in the small house down in the floodplains right?

That’s why management get to drive the big cars and the rest of us get to drive the small cars, right? As they say in the army: it’s the General(s) who must take the rap for losing the battles, losing men’s lives: losing the war. With all the big perks – comes the “responsibility and accountability’. Correct? Not so?

Years ago generals and managers were a rare and tough breed. They were usually sired and raised by hard driving, successful parents. They went to tough, demanding quality schools. And they had to prove their worth, their credentials constantly and from a very early age as well.

They had to become battled hardened veterans that knew much and had performed well in every sphere of the service, the business, the company and by a usually young but accelerated age too. Most of all, the successful managers and generals had the distinction, the responsibility – of leading and mentoring “from the front’.

Nothing inspires, motivates and educates the masses like an Alexander or Coriolanus-type general / “manager’ who leads his men from the front. Who suffers all of their battles and hardships alongside of them.

Maybe the problems today are too different for this romantic, anachronistic point of view to be applicable any more. Maybe. But I am not so sure.

I am not so sure that if today’s politicians, directors, generals and even managers – were encouraged, supported or even just “allowed’ to do more “hands on’ leading and managing “from the front’ – that we wouldn’t see a lot better performance from these companies than we have seen over the past eight years.

Who knows? Maybe there is still a place in this industry for a Coriolanus, a Stephen Jobs, a Bill Gates. Other industries seem to be still be benefiting from those types. Why not the gold industry as well?

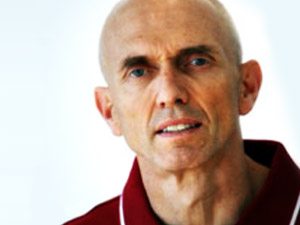

Peter Major leads the mining and resources division of Cadiz Corporate Solutions