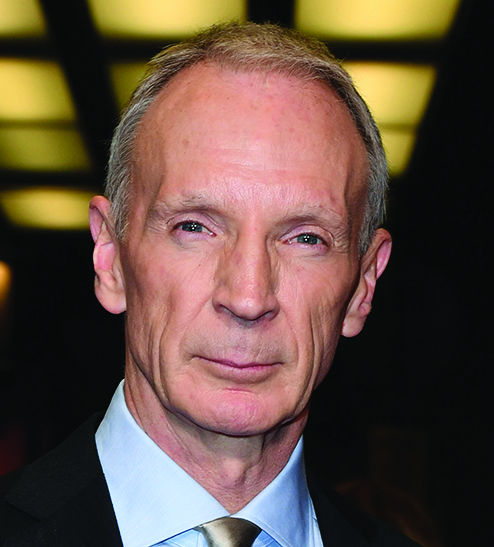

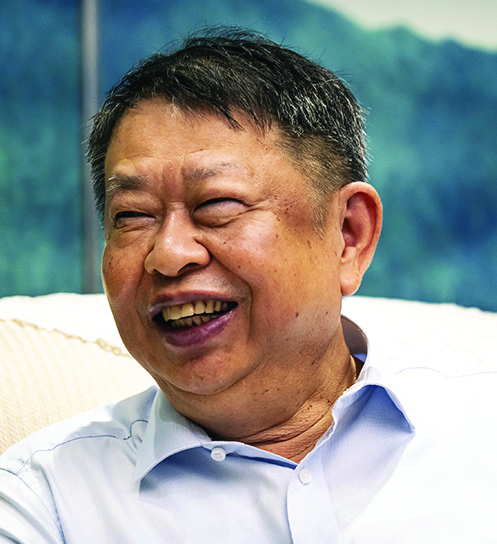

Chen Jinghe

CHAIR: Zijin Mining Group

'The mining industry will eventually feel the absence of Chinese capital if opposition to its investment continues'

“IN the first ten years, we developed gold and copper at Zijinshan. In the second, we expanded across China. And in the past ten years, we’ve turned to global expansion.’’ This is how Zijin Mining Group’s Jinghe described in an interview with Bloomberg News the state-owned behemoth’s strategy over the years.

Today, Zijin is fast catching up to Western counterparts BHP and Anglo American in helping drive global copper supply. Production of the metal has more than tripled over the past five years as new operations ramp up in Africa (Zijin is partner to Ivanhoe Mines’ Kamoa-Kakula in the Democratic Republic of the Congo), the Balkans and at home. On an equity basis, it was the sixth-largest copper miner in 2023. But Zijin is also diversifying. Founded as a gold company, it is closing in on Zangge Mining, a Chinese lithium miner, although hurdles in the form of investment bans by Canada and US tariffs have the potential to seriously crimp Zijin’s ambitions elsewhere. “All of this is quite regrettable,’’ Jinghe has said, echoing the words of Steele Li, co-chair of another Chinese miner, CMOC Group, regarding Western hostility.

The mining industry will eventually feel the absence of Chinese capital if opposition to its investment continues, he added. Zijin is, however, discovering pathways to growth. In October, it emerged as the winning bidder for the Akyem Gold Mine in Ghana, which it is buying from Newmont for $1bn. The group will also be highly interested in potential expansion at Kamoa-Kakula though whether it gets the chance is debatable. Ivanhoe says it might go it alone.

LIFE OF CHEN

The story runs that not long out of university, Jinghe was handed an assignment by a government official. Go to Zijin mountain, he was told, and find gold. That was in 1982. Bloomberg News describes how the geology graduate found himself on forested slopes in the remote, humid highlands of southeastern China. The bet paid off. The deposit his team eventually discovered became the nation’s biggest gold mine, and the foundation for the $67bn state-owned company it is today.