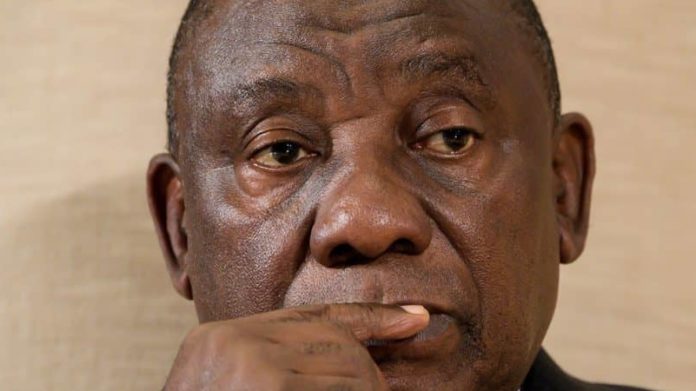

SOUTH African president, Cyril Ramaphosa’s State of the Nation (SONA) address on February 13 was the most critical since the start of the country’s democratic era given an unprecedented economic slump, said Minerals Council South Africa.

Roger Baxter, CEO of the council, said it was critical Ramaphosa gave the market strong signals that he intended reform including granting concessions over ports and other vital infrastructure, cutting the public wage bill and handing the National Prosecutions Authority the budget to bring about justice on former acts of state corruption.

“We understand that the president is being buffeted by a variety of perspectives from a range of constituencies,” said Baxter referencing the political pressures that Ramaphosa faces including unions which have time-honoured idealogical links with the ruling African National Party, as well as within the party itself.

“We would plead, however, that he use his powers of persuasion to impress upon all citizens the seriousness of the situation and, where appropriate, the need for radical measures to repair the damage done to South Africa since 2009 and to create a new foundation for growth and development,” Baxter said.

Government debt ballooned from 26% in 2008 to 56% of GDP in 2019, and threatens to rise further, said the Minerals Council. Unemployment had also risen to 29.1% – ten million people are unemployed – whilst in 2018 fixed investment fell by 1.4% to 17.9% of GDP against a global average of 26.3%.

The market will also be keeping a close eye for any acceleration in government plans for state-owned enterprises; Eskom, most critically, as well as South African Airways.

Baxter said Moody’s Ratings Agency was the only credit rating company that was prepared to keep South Africa at an investment grade, but its grip over this was tenuous.

Should it downgrade South Africa, there will be massive outflows as foreign funds sell off significant parts of their R118bn investment in South African bonds and a further R2 trillion in equities, Baxter said.