UK-listed diversified mining firm, Vedanta Resources, said it intended to expand its operational base in South Africa building on a decision in 2014 to develop the Gamsberg zinc mine at Black Mountain Mining (BBM).

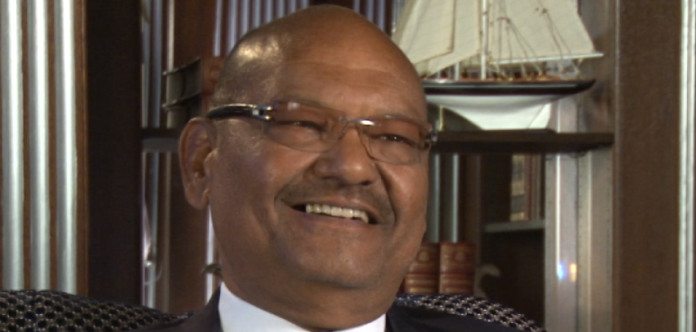

“We are committed to expanding our operations here and will continue to invest in our greenfield project at Gamsberg,” said Anil Agarwal, chairman of Vedanta. His comments were timed to coincide with this week’s visit of the Indian prime minister, Narendra Modi to South Africa.

“We already have a significant presence in South Africa and are well placed to help realise the vision of our prime minister of shared growth between India and South Africa in the future,” he added.

The Vedanta chairman’s comments run counter to the strategic decisions of other diversified mining firms BHP Billiton and Rio Tinto which have generally sought to lessen their exposure to Africa, and South Africa in particular.

BHP Billiton last year demerged non-core assets creating South32 which has manganese and coal mines in South Africa whilst Rio Tinto said this week it would halt the development of the Simandou iron ore project in Sierra Leone.

Vendanta is to sign two memoranda of understanding (MoUs) with South African companies for the development and supply of equipment and the transfer of technology.

The MoUs would improve safety and productivity at the mechanised underground mines of Vedanta’s subsidiary, Hindustan Zinc Limited, said Vedanta in a statement.

Tom Albanese, CEO of Vedanta, said in a recent interview with Miningmx that the company had been able to cut the capital cost of BBM a third to $400m because of the reduced investment from other parties in South African mining.

Said Albanese: “…part of it [cost-cutting] was actually getting better quotes … Gamsberg being the only major project in South Africa. People are chasing that business, and that helps the project”.

Gamsberg would consist of a 250,000 tonnes/year open pit zinc mine, a property previously owned by Anglo American and Gold Fields of South Africa.

A refinery would also be established at the nearby Skorpion mine which was first built by Anglo American producing 150,000 tonnes/year of zinc concentrate.

COAL OPPORTUNITY

South Africa’s coal mining industry provides an obvious business opportunity for Vedanta especially as thermal coal exports to India from South Africa have grown significantly over the past five years.

Albanese told Miningmx that demand for coal in India would remain a major part of the South African export mix, although he added the rider that recent growth, which has seen shipments increase a fifth, would not continue indefinitely.

Albanese also warned that the power utility industry, as well as the primary coal industry, had to find a more effective way of burning coal into electricity or “coal’s days will be limited” as the “political dynamic” was against it.

Commenting on South African exports, Albanese said that power stations situated on the Indian coastline would always want to import coal, including South African coals as they were the most “naturally adapted” for the purpose.

However, demand could taper.

“What we’ve seen happen over the past two years is that the coal demand for a variety of reasons in India in total rose much faster than coal mining supply, so what had happened was that imports of coal, not just to the coastal regions of India, but to all areas have risen quite substantially.

“We have coal burning power plants ourselves in the middle of coal basins and that are increasingly relying on imported coal to meet our needs even though we were within 100km of coal mines,” he said.