[miningmx.com] – ANGLO American Platinum (Amplats) may provide Atlatsa Resources with an additional C$41.8m (R422m) in financial support until 2016 following the slide in the basket price of platinum group metals (PGM).

This would be in addition to the refinancing package Atlatsa Resources negotiated last year in which it sold mineral rights back to Amplats for $171m, cut debt 75% to $150m and reduced the interest bill on the outstanding debt.

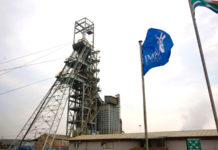

“The additional funds would be used for the company’s capital projects and to run the Bokoni mine,” said Joel Kesler, commercial director of Atlatsa Resources. Atlatsa operates the 120,000 oz/year Bokoni platinum mine situated in the northern part of the Bushveld Complex.

“The rand platinum basket has proved very volatile; it has been moving about. When we stress tested our mine plan and models, we found we may need to have access to funds,” Kesler said in a telephonic interview.

Kesler was commenting following the announcement of Atlatsa’s September quarter figures in which it posted a C$560,000 loss – a significant improvement on the C$15.5m loss reported in the 2013 September quarter.

The company generated a 31.2% increase in cash to C$9.7m during the period, but the need for additional finance spooked the market with shares in Atlatsa Resources falling 17%, or 50 South African cents/share, to R2.40/share.

In its announcement, Atlatsa said the additional finance was “… in the event of unforeseen circumstances not within the company’s control that may result in Bokoni mine not meeting its planned cash forecasts”.

Atlatsa is currently spending up to C$100m in doubling the production of Bokoni to 240,000 oz/year in lower cost platinum production, due by 2019. The firm’s total cash balance stood at $13.8m excluding restricted cash at the quarter’s end.

Amplats has a 49% stake in Atlatsa Resources which is a major constituent of the Anglo American subsidiary’s empowerment scheme. However, the company announced on 21 July that it wanted to sell its shares in the company because it “was not the best partner”.

Atlatsa said it “… continued to engage” with Amplats and the Department of Mineral Resources regarding Amplats’ announcement on its potential exit from the Bokoni joint venture.

The Bokoni mine performed solidly in the September quarter lifting production to 52,025 PGM ounces from 47,611 PGM oz in the corresponding quarter of the previous financial year.

“This increase is attributable to an improved underground mining performance, better operating efficiencies, improved mining flexibility and improved grade control,” the company said in its announcement. Its projects remained on track, it said.

Commenting on prospects, Atlatsa said the Bokoni mine was “well positioned” to meet a 10% year-on-year targeted growth rate on PGM ounces for the 2014 financial year “as

mine management focuses on improving mining efficiencies, disciplined capital and cost management,” it said.