[miningmx.com] – EVEN if the strike in the South African platinum sector were to end today, Impala Platinum (Implats) and Lonmin could count on almost negligible production for the first half of the 2014 calendar year. What slim revenue will be booked, will be from stockpiles.

According to Implats, it can probably stretch stockpiles to the end of April for its South African clients, partly as some customers cut purchases believing they had enough material anyway, said Johan Theron, head Implats’ corporate affairs.

Anglo American Platinum (Amplats) is still producing some metal and according to analysts could stretch seven weeks of inventories to 38 weeks. Lonmin isn’t commenting on its inventories, or hits to production. “We are assessing our options as the days go by,’ said spokesperson, Sue Vey.

The fact of the matter, however, is that another month of strike action is going to see the financial pressure at South Africa’s platinum companies climb. “We don’t expect to register much new production at all in the second half of our financial year,’ said Theron who judged the period to be the worst financially in his 17 years at the company.

Writing in February, Justin Froneman, an analyst for Standard Bank Group Securities, said that based on a nine week strike, followed by a three week ramp-up period, platinum production losses at Implats would be about 200,000 ounces.

“This implies Implats’ worst financial result since the early 1990s,’ he said. The strike is currently approaching its tenth week.

As a result, it’s possible that even with the strike concluded before the month, the consequences for investors and employees are already hard-wired into the companies’ futures. It’s simply not possible to walk away from worst ever financial performance free of consequence.

Mpumi Sithole, spokesperson for Amplats, wouldn’t comment on long term effects. “It’s dangerous speculation. We’re just trying to get our workers back to work. It’s not something I’d comment on knowing what I know.’

Part of the long-term consequences of a two-month strike in an industry where, until recently, 60% was loss-making, is that resources and reserves are harmed, potentially permanently.

Terence Goodlace, CEO of Implats, said at the company’s interim results presentation in February that about 5% of panels at the firm’s Rustenburg lease area would have to be re-developed.

Re-developing panels is a financial decision in which the mining firm must weigh up whether the cost of accessing the resources again is worth the time and trouble.

Says Theron: “We are about to do a new survey, but I imagine up to 10% of our panels are now in the red zone (requiring re-development)’. As he describes it, the company must decide to either write-off those resources and run a smaller operation, or take up the cost of retrieving the resources.

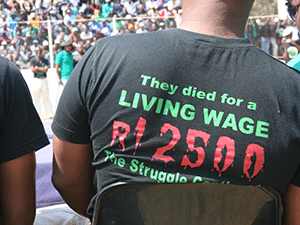

This also leads platinum companies to weigh up cost per employee. The R12,500 per month demanded by the Association of Mineworkers & Construction Union (AMCU) makes companies assess that if that’s the future cost of labour what do they need in labour to make the mine viable.

Inevitably, mechanised mines make more sense than labour intensive operations, the type that predominate in the Rustenburg region. In the absence of substantial changes to the Labour Relations Act where strikes are interminable, mining companies will take AMCU’s stance as a signal to run smaller companies with a higher level of mechanisation.

The chance of wage talks re-starting soon is also questionable. South African deputy president, Kgalema Motlanthe, is to hold a scheduled forum with mining companies on March 27 (Thursday) at which the strike will most likely be addressed.

The forum, to which unions are invited, won’t be attended by AMCU president, Joseph Mathunjwa, however, if he sticks to protocol and leads another union march planned for the same day to the premises of Implats.