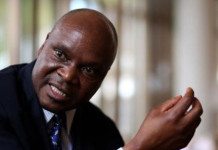

[miningmx.com] – ANGLO American CEO, Mark Cutifani, said it was “frustrating” that some $1bn in company cost-cutting and productivity improvements had been obscured by a quicker-than-anticipated deterioration in the mining sector.

Addressing the Mining Indaba conference in Cape Town, he added that the group would within days detail plans to withdraw from a number of mining investments “in several countries around the world”.

“Transforming the operational performance of the company, while also taking the hard but necessary choices about some of our assets, has been an essential part of turning around the ship in what I have always said would be a five-year exercise,” he said.

“We have come a long way already – both in terms of well north of a billion dollars of cost, productivity and other improvements, as well as selling peripheral businesses and other assets.

“But we are not there yet and the benefits are harder to see when the market is falling away from you faster than you can deliver the positive change.

“That can be frustrating, but that’s life and I’ve been around long enough to know that it only highlights the need to make the really tough decisions – that some may dodge in sunnier times – that are absolutely necessary if we are going to rebuild this great company’s competitive position,” said Cutifani.

Anglo American is on February 16 expected to outline how it intends to reduce its asset base by up to 60% as announced in an investor update in December.

At the update, Cutifani unveiled that Anglo had stopped dividend payments and raised the prospect that previously sacrosanct mining operations, such as the Minas Rio iron ore operations, could be sold.

Already, the group is hoping to retrieve $1bn from its niobius and phosphate business having already announced plans to sell Rustenburg Platinum Mines and Tarmac, its aggregates business.

Commenting on the outlook for the mining market in 2016, Cutifani said he was unsure whether conditions would improve or worsen saying mining firms could not rely on a reversal of the slump in prices.

“For many of us in the industry, 2016 is already shaping up to be the most challenging yet. Opinions are divided on whether we have reached the bottom of the cycle. So things may still get worse before they get better,” he said.

“In the less than three years I have led Anglo American, the commodity markets have been on a perpetual downward curve – the steepest I have seen in almost 40 years in the industry,” he said.

Global mining stocks have lost $1.4 trillion of market value since 2011 which is more than the combined value of Apple, Exxon/Mobil and Google,” said Cutifani. “That’s pretty sobering stuff,” he said.