RBPlat gives up 5% as interim loss hits home

Shares in Lonmin lost about 12% taking losses for the last 30 days to over 40% while Royal Bafokeng Platinum said it would post an interim loss.

Platinum sector must get fuel cells into gear

Faced with falling consumption of diesel cars and the rise of electric vehicles, now is the time for the platinum sector to deliver on long-standing fuel cell technology.

Dismay as Zim indigenisation talks stall

South African platinum firms have been unable to progress indigenisation deals with the Zimbabwean government with both sides stuck over compensation.

Bokoni Mines on knife-edge as R422m deal fails

The failure to supply R422m to Atlatsa Resources' Bokoni Mines had put the sustainability of the company at risk and triggered urgent refinancing discussions.

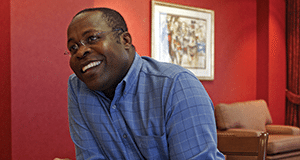

Amplats to cut 420 managerial jobs as market bites

The consolidation of Anglo American Platinum's operations, and a deteriorating platinum market, has meant some 420 jobs are surplus to requirements.

Lonmin playing “game of chicken” with market

Analysts think Lonmin has the least flexibility of its peers and will almost certainly end up a smaller company, especially whilst it holds back on refinancing.

Tharisa hopes interim profit is shape of future

Tharisa produced its first headline earnings despite lower prices and chrome output and said it was targeting debt which had topped $99m.

Amplats to post 20% interim earnings lift

Anglo American Platinum would report interim share earnings of more than 20% on an improved operational performance.

Implats calls off Marula sale, looks to expand

Impala Platinum has abandoned plans to sell its 78,500 oz/year Marula platinum mine saying, instead, it will expand the operation.

PTM consolidates Waterberg projects

Platinum Group Metals consolidated its platinum prospects on the Northern Limb of the Bushveld and attracted $20m in exploration investment.