SHARES in Alphamin, a tin mining and development company, are up about 81% in the last 30 days on the back of a stream of positive operational news underpinned by the tin price, itself many multiples higher than a year ago.

The company’s mine Bisie, in the northern reaches of the Democratic Republic of Congo, is ramping up to installed capacity of 12,000 tons of tin concentrate a year and there are plans to expand south of the current mining area. Debt is expunged, after almost crippling the company in 2020, and a maiden dividend has been announced.

Speaking to the Financial Mail, Alphamin CEO Maritz Smith said that as a rule of thumb about half of Alphamin’s EBITDA will be converted into cash. Bisie’s all-in sustaining costs are about $14,000/t. Set against the tin price of more than $41,000/t currently that’s a mile wide margin.

“Provided the tin price stays above $23,000 per tonne … money floods to the company’s bottom line creating a virtuous circle of cash generation,” said Christopher Eccleston in a 2021 report for New York based investment firm, Hallgarten & Company.

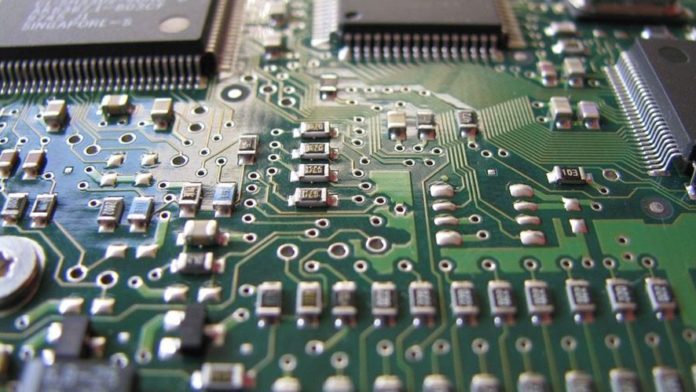

‘Tin bulls’ describe the metal as “the glue” of the internet of things. The reference is to its end use as a solder in the manufacture of electronics, as well as packaging. But tin also has an application in the manufacture of lithium-ion batteries, the science behind electric vehicles. Cited by a Reuters report last year, the International Tin Association reckoned 60,000 tons of tin demand can come from electric vehicles alone.

Alphamin’s own studies suggest that even at an annual growth rate of between 2% to 3% an additional 8,000 to 10,000/t in tin demand will be generated. Bisie is shooting for production of 12,000 t this year which means global demand needs a new mine like Bisie every year for the foreseeable future, said Smith.

Set against this demand picture new tin production to help plug the demand growth is limited. “It’ll take time for new mines to come on stream so there’ll definitely be an interim lag,” said Smith. “We could see the tin price higher over the next two to four years.”