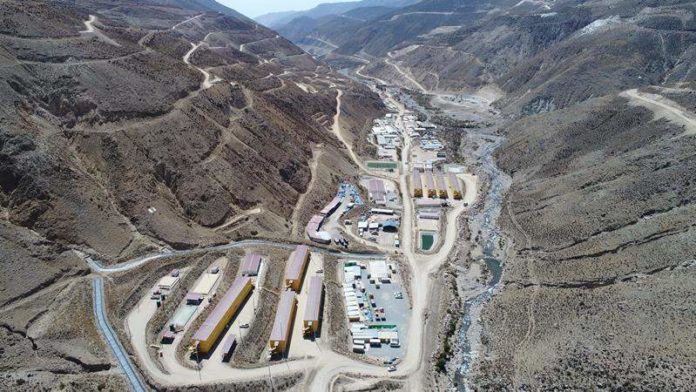

ANGLO American said it had started commercial production of copper from Quellaveco, its newly commissioned Peru project held in joint venture with Mitsubishi.

However, the UK-listed miner has revised production guidance for the 2022 financial year down to between 80,000 to 100,000 tons for the year after waiting for regulatory approvals and completing testing. Anglo had previously estimated production for the year of between 100,000 and 150,000 tons.

As a result of lower production, unit costs would also increase. Previously stated at about 135 US cents per pound (c/lb), the new unit cost estimate would be about 150c/lb, the group said. Production guidance for 2023 and 2024 was unchanged at 320,000 to 370,000 tons of copper as the mine ramped up its run-rate over the next eight to 12 months.

First concentrate from the $5.3bn project was achieved in July. Quellaveco would produce an average of 300,000 tons in copper equivalent production a year over the first 10 years of the project. “Quellaveco alone is expected to lift our total global output by 10% in copper equivalent terms and take our total copper production to close to one million tons per year,” said Duncan Wanblad, Anglo American CEO in a statement.

Anglo also tightened production guidance for copper production out of Chile where the group owns the Los Bronces mine. It would be reduced to between 560,000 to 580,000 tons of copper compared to previous guidance of 560,000 to 600,000 tons.

This was a result of water restrictions and a change in ore characteristics which reflects in the lower volumes and inflation, the group said. Unit cost guidance for Los Bronces was consequently adjusted higher to 160c/lb compared to 150c/lb previously.

Anglo stands out among its peer group because it offers production growth as a result of Quellaveco. Analysts believe the world is heading for a major deficit in copper supply owing to a lack of investment.

Analysing the outlook for copper supply, Goldman Sachs said in a report earlier this month that the world’s mining companies needed to spend an aggregate $150bn in capital expenditure over the next 10 years to solve an expected deficit of eight million tons annually. The likelihood though was growth capex would be 40% down on capital spent in the previous ten year period as a result of investor preference for shareholder returns.

A one third decline in the copper price since March – a result of investor fears over global recession – would only worsen the long-term supply deficit as companies would be discouraged from laying out capital for new projects, according to a report by Bloomberg News last week.

“We’ll look back at 2022 and think, ‘Oops,'” John LaForge, head of real asset strategy at Wells Fargo told the newswire. “The market is just reflecting the immediate concerns. But if you really thought about the future, you can see the world is clearly changing. It’s going to be electrified, and it’s going to need a lot of copper.”