[miningmx.com] – SHAREHOLDERS in Anglo American will be heartened by data from its 85%-owned subsidiary, De Beers, last month that showed record diamond jewellery demand in 2014 of $81bn.

The diamond miner and marketer comprised 42% of Anglo American’s earnings last year and is tipped to become the foundation of the UK miners’ earnings this year at a time when Anglo continues to restructure some $4bn worth of assets, mostly through trade sales.

For a company that sells timeless love in a jewell for a living, De Beers is also providing its parent with priceless time propping up earnings while the UK-listed group continues to trawl through its “to-do’ list consisting of disposals, efficiency improvements, overhead removals – a process now into its third year.

Commodity markets have bounced worryingly between despair (coal and iron ore) and hope (copper and zinc), but selling diamonds to the world’s middle classes is proving good business even if many developed markets are gripped by government-imposed austerity measures.

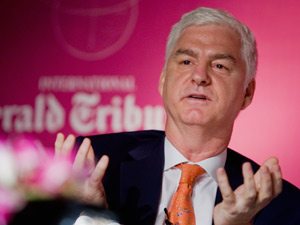

In the words of Stephen Lussier, vice-president of De Beers’ marketing division, the improvement in diamond sales is a “triumph of hope over experience’, a reference to the fact that diamond studded engagement rings drive jewellery sales, especially in the US which comprises 46% of demand.

“The jewellery retail market is a key component in achieving rough sales [for De Beers] and while it’s difficult to call … we are encouraged by the consumer data,’ said Lussier when asked about De Beers’ contribution to Anglo this year.

De Beers will also be lifted by news that UK bank Barclays has stepped in to fund the polishing and cutting business which buy rough diamonds from De Beers but that found credit for their activities difficult to arrange after KBC Groep wound down its Antwerp Diamond Bank unit.

The result was that the polishers and cutters were forced to sell inventories in order to fund new diamond purchases, a development that briefly flooded the market had hurt rough diamond prices.

Barclays will be joined by banks such as Emirates NBD PJSC and Mashreqbank PSC which are helping to finance the Dubai Diamond Exchange, established to rival the traditional dominance of Antwerp in the diamond cutting and polishing industry.

But for how long can Anglo continue to rely on diamond sales growth? There have been periods when diamonds have massively under-performed ranking De Beers as a mere footnote to the group’s performance.

According to Philippe Mellier, CEO of De Beers, the medium- to long-term outlook for diamond retail sales is strong owing to the buying habits of consumers in China and India.

“As the number of middle class households in the major consumer markets is set to grow by hundreds of millions in the years ahead, the medium to long term prospects for the diamond industry are also exceptionally strong if the right investments continue to be made across the value chain,’ said Mellier in a De Beers’ announcement in March.

Said Investec Securities in a recent report: “We support the De Beers view that prices will resume their upward trend given strong and growing demand out of the US and continued growth from China’.

In addition to his marketing responsibilities, Lussier is also CEO of De Beers’ Forevermark , its direct foray into the retail market. There’s been success, especially in China, where sales now are reaching the so-called third or fourth tier cities.

“These are away from your Beijings and Shanghais,’ said Lussier who added that those economically capable of buying diamond jewellery were not middle class in the traditional western way, but nonetheless earning $30,000 to $35,000 a year and driven by the need to celebrate weddings and engagements with diamond jewellery.