BOTSWANA would defend its diamond producing interests, including its 15% in De Beers, in the event of a takeover of Anglo American, according to a report by Bloomberg News.

BHP confirmed press speculation on April 25 that it had proposed a takeover offer for Anglo. Valued at about $39bn, the proposal was rejected by Anglo the following day. Anglo owns the controlling balance of De Beers.

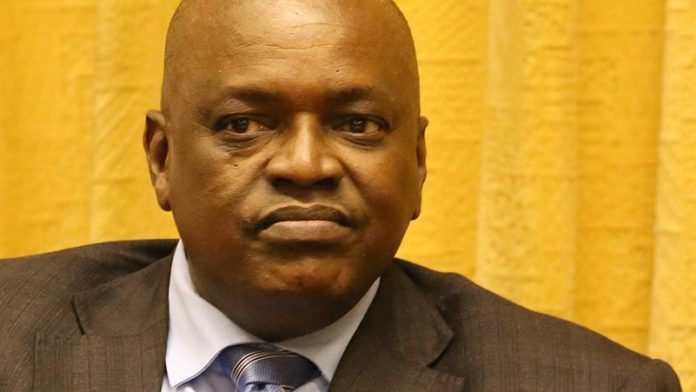

Citing comments by Botswana president Mokgweetsi Masisi, the newswire said that a bid for Anglo by BHP would be met with challenges on several fronts including potentially difficult negotiations with Botswana as well as the scrutiny of antitrust authorities from China to South Africa and Japan.

“No way would we allow ourselves to willingly be made redundant or irrelevant,” said Masisi in a television interview on Wednesday with CNBC Africa. “So Botswana will respond in ways that are protective of its interests.”

“The value of De Beers is fundamentally created by Botswana,” Masisi added. “That can never be missed by anybody.”

Botswana is the world’s largest producer of rough diamonds by value, with the revenues making up the bulk of the southern African country’s budget receipts, said Bloomberg News. Anglo estimates that its total economic contribution to Botswana was $1.16bn last year, with almost half of that coming from taxes and royalties.

De Beers agreed to hand over more diamonds to Botswana’s government in negotiations that concluded in the middle of last year, just as the latest deadline for a deal expired, the newswire reported.