[miningmx.com] – KUMBA Iron Ore is to close its Thabazimbi mine in South Africa’s Limpopo province following a review which also included the possibility of selling the ailing asset.

The closure of the mine would affect 800 employees and 360 contractors, the company said in an announcement to the Johannesburg Stock Exchange. Kumba was conducting

“extensive consultations”, it added.

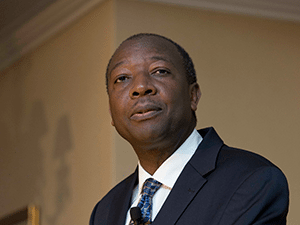

“Closing a mine is a difficult and painful process and its impact cannot be taken lightly,” said Norman Mbazima, CEO of Kumba Iron Ore.

“We have looked at all options to further sustain the mine, having already extended its life several times in recent years, and have come to the inevitable conclusion that this mine has now come to the end of its life,” he said.

In its announcement, Kumba said a combination of factors had informed its decision to shut the mine including the fact it was 80 years gold and had previously postponed its closure six times in the last 15 years by approving extension plans.

Other factors included difficult mining conditions owing to inherent geotechnical complexities which had been exacerbated by a limited remaining iron ore resource. The mine also suffered from high operating costs related to high waste stripping.

A slope failure on June 6 had also rendered the iron ore resources in the one remaining pit uneconomic to mine, Kumba said in its announcement.

“These are challenging times for the iron ore industry and difficult times for our employees and the mine’s contractors,” said Mbazima. He said in February at Kumba’s full-year results presentation that closure was a possibility for the mine.

Kumba announced on July 15 that headline earnings per share would be up to 63% lower owing “the significance decrease in export iron ore prices. The price of iron ore is around $50/t after cresting more than double that two years ago.

It was reported on July 10 that Kumba would retrench about 190 jobs from its Sishen and Kolomela iron ore mines owing to difficult market conditions.

The announcement at Kumba represents another blow to Anglo American which controls the company and said earlier today that it would book impairments of $3bn to $4bn at its iron ore and coal assets.

“It underlines the fact that those assets are probably not going to make any money,” Ben Davis, an analyst at investment bank Liberum, told Reuters.

The impairment charges come on top of a $3.9bn write-down Anglo took for similar reasons in February, when it also posted a 25% drop in underlying operating profit for 2014, said Reuters.

Anglo added that production from De Beers, which was a mainstay of its results in its 2014 financial year, would be 6% down for the half-year ended June 30.