ANGLOGOLD Ashanti ought to sell its last remaining mine in South Africa as it would remain high cost and could not compete for capital, said Bloomberg News citing analysts.

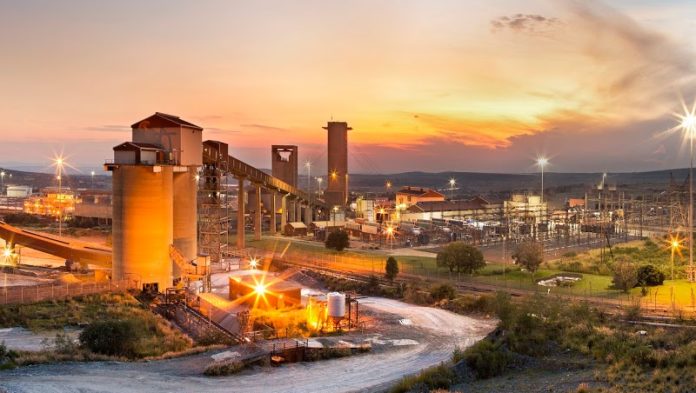

The group, which recently appointed former Barrick Gold executive, Kelvin Dushnisky, as CEO, operates Mponeng, and surface re-treatment facilities in South Africa. Production from the country of its founding comprised 14% of total company output in the third quarter, down from 26% a year earlier.

“Their best bet is to get out of South Africa and leave Mponeng behind,” said René Hochreiter, an analyst for Noah Capital Markets.

“The costs never come down in South African gold,” he said, recommending the company could boost its value by leaving the country. It was speculated in December that AngloGold was considering a listing in London, where it might replace the premium gold company vacancy left by Randgold Resources following its merger with Barrick Gold, or in Toronto.

“They are not going to invest here,” Leon Esterhuizen, an analyst for Nedcor Securities, told Bloomberg News. “Whether it’s AngloGold or anybody else in South Africa gold, it makes sense to go and find other places to make money.”

Bloomberg News identified Sibanye-Stillwater and Gold Fields as potential acquirers of Mponeng, but it noted that both firms had operational challenges of their own: Sibanye-Stillwater had not yet completed the takeover of Lonmin, whilst Gold Fields was focused on bringing its South Deep mine to profitability after some 10 years of losses.