HARMONY Gold is set to report a 253 cents per share turnaround in fortune for the six months ended December despite producing much less gold than in the interim period of the previous financial year.

Share earnings were estimated to come in at 249 cents per share which compares to a four cents per share loss in its 2019 financial year.

The improvement was largely down to a 19% increase in the rand gold price which averaged R683,158 per kilogram in the six months ended December compared to R572,898/kg previously. This more than offset the poor production period.

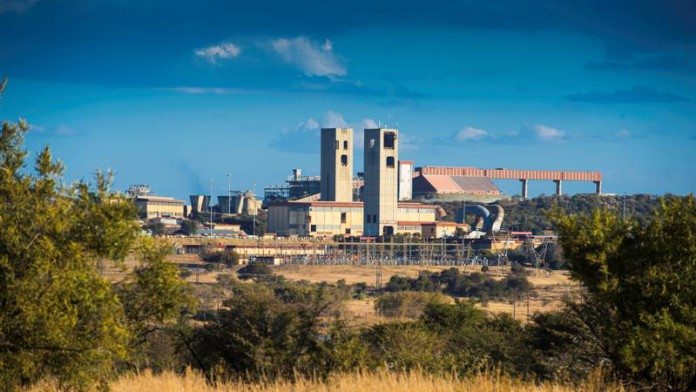

Harmony said in a trading statement today that it suffered “grade issues” at its Kusasalethu and Target gold mines which contributed to a 6% reduction in underground recovered grade to 5.29 grams per ton. As a result, total gold produced for the six months was 8% lower at some 688,379 ounces, or 21,411/kg.

Harmony Gold also said it had restated its previous year’s interim earnings following a bona fide error in the calculation of its borrowing costs as they should have been stated in the IAS 23 accounting standards.

The outcome of the correction was an increase in the comparative period’s amortisation and depreciation by R10m as well as finance costs by R84m. This decreased net profit for the six months ended December 2018 to four cents from a profit of 15 c/share previously.

According to RBC Capital Markets vice-president for global mining research, James Bell, the market may be supportive of a gold price above $1,500/oz for the foreseeable future, although he added that another catalyst was required to move higher than that. Such a catalyst could come from a sell-off in the equity markets.

Speaking at the Mining Indaba conference in Cape Town this week, Bell said: “We are deep, deep into a bull market for equities – this rally started in 2009 and stock markets are at an all-time high right now.

“We think from an RBC perspective that stock markets could have a less good performance from here. We are not calling for a recession in the next 12 months, but we do not think investors should be complacent.

“If there is a correction in equity markets gold prices should do well purely because people see gold as a safe haven and a hedge against risk.”

Bell pointed out the current gold price rally which started in 2016 had already run longer than some previous gold price rallies but he believed it still had “… upside from a price perspective”.