PRIVATELY-owned Aurous is to list South Africa’s Blyvooruitzicht (Blyvoor) mine on Nasdaq, announcing on Monday the mine’s acquisition by blank cheque company Rigel Resource Acquisition Company (Rigel).

The transaction values Aurous at $362m and will see about $50m raised before costs to fund production and optimisation projects at Blyvoor mine, including the development of gold tailings owned by Gauta Tailings which is also a deal participant.

Rigel shareholders will receive cash and shares equal to $10 per share. Rigel is backed by Orion Resource Partners, a money manager with about $8bn in assets.

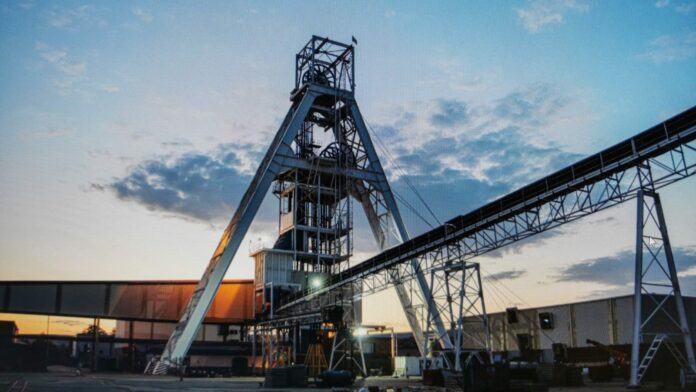

Established in 1937 and producing its first gold in 1942, Blyvoor is a storied asset in South Africa’s gold mining industry.

It was the richest orebody in the West Wits line of gold discoveries but fell into disrepair when closed by Village Main Reef leaving thousands of employees facing poverty. The mine was plundered by thieves until it was bought out of liquidation by the late Peter Skeat, a renowned gold industry entrepreneur.

The mine was completely re-equipped by Aurous, headed by CEO Richard Floyd and executive chairperson Alan Smith, the former COO of AngloGold Ashanti. When Blyvoor resumed operations, amid the Covid-19 lockdowns, it produced about 30,000 ounces a year.

Aurous said it intended to ramp up Blyvoor to an average annual output of 150,000 oz at an all-in-sustaining-cost (AISC) of $815/oz. There was the prospect of “further upside” from Gauta Tailings, the company said.

Gold shares are thriving at the moment, especially rand hedge stocks Harmony Gold and DRDGold following a 16.7% increase in the dollar gold price over the last 12 months while in rand terms, the price received per kilogram is 19% higher.

“This transaction represents one of the first significant gold industry deals in South Africa in some time and is expected to enable Blyvoor to expand its underground infrastructure, enhance surface infrastructure and optimise operations by achieving economies of scale,” said Floyd in a statement.

The transaction is expected to close in the second half of this year.