AUROUS Gold said it had raised $7.5m as part of its proposed merger with New York listed blank cheque company Rigel Resources Acquisition Corp.

“Aurous Gold and Rigel continue to advance discussions with a range of strategic and institutional investors to raise a total $50m of PIPE (private investment in public equity),” said Aurous Gold.

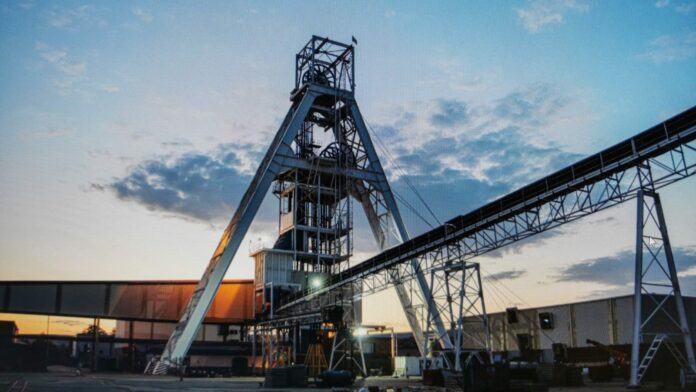

Aurous Gold owns Blyvooruitzicht gold mine, west of Johannesburg. The mine, which first opened in 1942, produced 5,767 ounces in the second quarter of its 2025 financial year taking half year production for the 2025 financial year to 10,934 oz.

It has targeted gold production of 80,000 oz within three years of closing the PIPE funding and a six year target of 150,000 oz annually.

Rigel Resource Acquisition Corp. is backed by Orion Resource Partners, a money manager with $8.5bn of assets.

“On the back of record gold prices, Aurous Gold continues to implement its updated yet conservative plan to build a solid operating foundation for future growth,” said Richard Floyd, CEO of Aurous Gold in a statement today.

“Our merger with Rigel will provide the anticipated capital injection, which we expect will greatly improve operational flexibility to grow the planned high-margin productive capacity safely and consistently.”

Aurous also said it had concluded a 30-month wage agreement with the Blyvoor Workers Union this month. The agreement “provides us with greater certainty around inflation of our largest cost driver, being labour,” the company said.

Blyvoor was the richest orebody in the West Wits line of gold discoveries but fell into disrepair when closed by Village Main Reef leaving thousands of employees facing poverty. The mine was plundered by thieves until it was bought out of liquidation by the late Peter Skeat, a renowned gold industry entrepreneur.

The mine was completely re-equipped by Aurous which has Alan Smith, the former COO of AngloGold Ashanti as its executive chair. Izak Marais, formerly COO of Gold One International and a gold manager at Gold Fields, is the company’s COO.

Aurous’ planned capital raising comes at a time of record gold prices. At the time of writing gold was trading at $2,633/oz, an improvement of nearly 44% over the last 12 months.