ANGLOGOLD Ashanti today said its proposed takeover of Centamin had been approved by the Egyptian competition authorities keeping the $2.5bn deal on course for its fourth quarter completion.

“AngloGold Ashanti and Centamin are pleased to announce that approval of the transaction has been received from the Egyptian Competition Authority and that the competition condition as set out in paragraph 6 of Part 3 of the Scheme Document has now been satisfied,” the New York listed gold miner said.

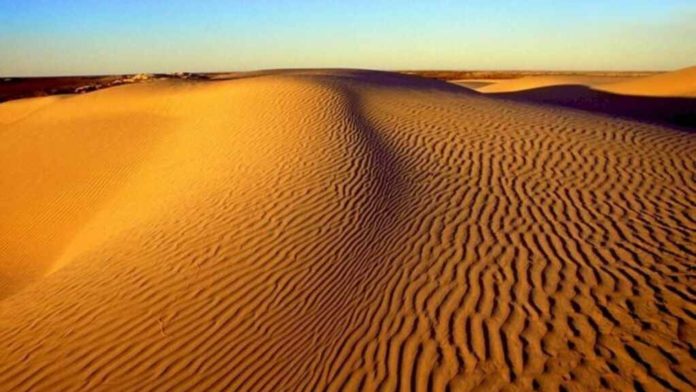

In September, AngloGold announced the share and cash takeover of Centamin which operates the 470,000 ounce a year gold mine Sukari, situated in Egypt’s portion of the Nubian gold shield district.

There are still conditions precedent before the deal is consummated including the sanction of the Scheme by the Jersey Court, AngloGold said.

Under the terms of AngloGold’s offer each Centamin shareholder will be entitled to receive 0.06983 new AngloGold shares and $0.125 in cash. The offer, including new shares issued to Centamin, valued the company at £1.9bn ($2.5bn) at the time of the announcement.

AngloGold Ashanti shareholders will own about 83.6% of the combined company’s enlarged share capital while Centamin shareholders will own about 16.4%. Centamin shareholders will also be eligible to receive its recently declared interim dividend, which was due to be paid in September, of $0.0225 per Centamin share.

The deal is one of the latest in mining sector merger and acquisitions and follows rival Newmont’s $14.5bn takeover of Newcrest last year and Gold Fields’s C$2.16bn pitch for Canada’s Osisko Mining. The total value of mining sector deals across all metals year-on-year increased 3% to $64bn in 2023, according to a report by PwC, an auditing firm.

Once concluded, the acquisition of Centamin will boost AngloGold’s production to nearly 3.1 million ounces annually making it the world’s fourth largest gold producer.

Sukari also helps lower AngloGold’s all-in sustaining cost (AISC), averaging $1,196/oz for the 12 months ended December compared to AngloGold’s $1,500 to $1,600/oz guidance for the current financial year.