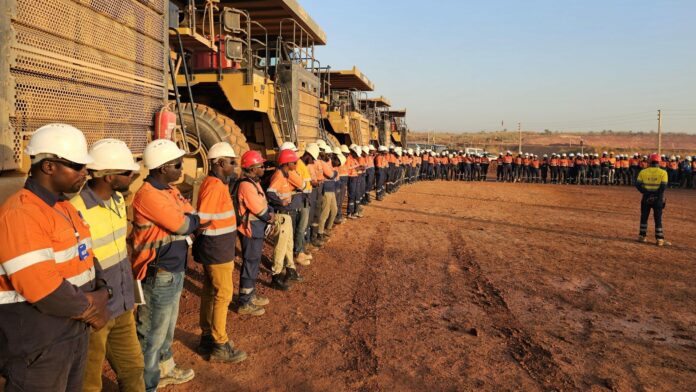

HUMMINGBIRD Resources said its Kouroussa mine in Guinea had reached commercial production with gold output for the year likely to be between 45,000 to 50,000 ounces.

However, Kouroussa’s trailing weekly production was below target and even though the mine was contributing to revenue, it was insufficient to solve Hummingbird’s liquidity crisis.

A trailing average of 1,900 oz per week had been produced at the mine this year, below the targeted 2,000 to 2,500 oz. In addition, the gold was sold at $2,473 per oz which was less than spot owing to a hedge that is due to complete in the first quarter of 2025.

Hummingbird said it was intent on improving the performance of Kouroussa having now achieved commercial production. The mine is set up to produce about 100,000 oz/year over an initial six year life of mine. This year’s production will be produced an an average all in sustaining cost of below $1,400/oz.

Despite the decent margin at the Guinea mine, Hummingbird’s outlook remained parlous, partly owing to the continued underperformance of Yanfolila, a mine in Mali. Hummingbird also disclosed it was in “negotiations” with Mali’s military junta. Although not detailed, the talks most likely relate to tax payments.

Mali has been seeking to extract more taxes from mining companies operating in its borders. Resolute Mining has agreed to pay the state $160m while other miners including Allied Gold and B2Gold have agreed new fiscal arrangements in terms of Mali’s recently legislated 2023 Mining Code.

Said Hummingbird of its overall financial position: “The group as a whole is not expected to generate sufficient near-term cashflows to significantly ease its current liquidity challenges. It was working with lenders to “strengthen its financial position, and establish greater stability”, it said.

Hummingbird announced that Nioko, its largest shareholder via its interests in the firm’s key lenders, was considering making an offer to minority shareholders and then delisting the company.