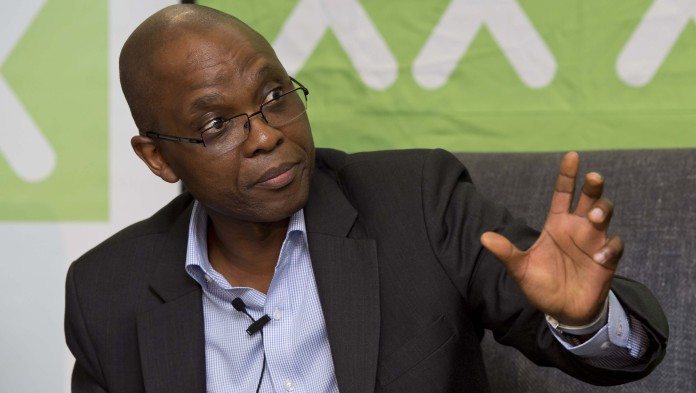

THE surprise departure of Wim de Klerk, financial director of Exxaro Resources, comes at a difficult time for Mxolisi Mgojo who will only have been CEO of the group for six months by the time De Klerk leaves.

Billed as among South Africa’s best financial directors by Sipho Nkosi, Mgojo’s predecessor, De Klerk, is due to take up the reins as head of ArcelorMittal South Africa, itself a tough watch.

That’s in September, however. For the next six months, De Klerk will assist Mgojo in making a series of important junctures some of which require careful strategic decision-making. The refinancing R8bn worth of long-term debt following a downgrade of the group’s credit rating last year is among the more pressing of tasks.

There’s also the question of restructuring Exxaro’s black economic empowerment shareholding.

De Klerk said Exxaro wanted to remain at least 50% black-owned in a new deal that may include, in a single entity, empowering the Total Coal South Africa assets – renamed Exxaro Coal Central (ECC) – as required by the South African government as a condition to the $382m (R5.8bn) takeover of the company which dates from 2014.

The BEE restructuring will be complex as it will need embedding a kind of DNA that is able to withstand a decade of market oscillations, which is a long time in mining. For instance, the current empowerment structure landed in hot water after the value of the asset became less than the bank debt provided to create the ownership following a slide in equity values – itself a function of lower metal prices.

Of Exxaro’s BEE commitments, De Klerk said it was important to create a robust structure. “The decline in the commodity prices has hurt us. It is difficult in this market of ups and downs to put something together that will last 10 years. But it is well developed; it is far advanced,” he said of the new structure.

Thirdly, Mgojo and De Klerk will hope to have some clarity on what to do with Exxaro’s passive investments in Sishen Iron Ore Company (SIOC) of 19.9% and 43.9% in Tronox. Neither investment is adding much to Exxaro given the slump in commodity markets. Tronox has promised a far reduced dividend in the future while SIOC parent company, Kumba Iron Ore is being sold or unbundled by 70% shareholder, Anglo American.

Finally, there’s the issue as to whether Exxaro makes a run at the coal mines of Anglo American which have also been put on the block. Some are Eskom dedicated – Exxaro has no interest in increasing its exposure to Eskom – but others are export only.

The key question here is whether Exxaro wants to become wholly focused on coal or remain exposed to other commodities. It’s a sign of the uncertainty still at Exxaro that there are mixed messages about how Mgojo and De Klerk feel about this.

Officially, Exxaro has stated the investments are up for review. It said it would “… evaluate our continued shareholding in key investments and assess the ability of these investment to contribute to our future earnings and cash flow”.

Speak to Mgojo, however, about the virtues inherent in becoming a coal ‘pure play’ and he’s ambivalent. “Kumba was praised for being a pure play once,” he said of the rise and fall of the iron ore producer which has been stricken by the collapse in the iron ore price.

“You have to think about the pure play option as there can be disruptors to coal,” said Mgojo. “It may work for five or 10 years, but storing renewable power for baseload supply could change the traditional coal-fired power station model.” So there are no givens.

Analysts think that the defensive qualities of the coal sector would stand Exxaro in good stead and think that the company should make a run at the coal mines that Anglo American also wants to sell which they value at R1bn, as well as divesting of its iron ore investment.

“We continue to see a relatiely high quality defensive core coal business at Exxaro. We believe South African coal mining is the company’s core competence and should be nurtured and grown while opportunities exist in the space,” said one.

What’s tricky for Mgojo is that he’s the guy who’ll have to live with consequences of these strategic decisions. De Klerk will be at AMSA whilst Nkosi has moved into retirement (although he promises to remain a committed Exxaro pensioner along with another former CEO, Con Fauconnier).