ATLATSA Resources, a platinum development company, is to cut more than half of some 6,101 employees at its Bokoni Mines operation in the north-eastern Bushveld Complex in terms of a restructuring plan first announced in September.

It has also agreed to co-operate with plans by its joint venture partner Anglo American Platinum (Amplats) to divest of its 49% stake after accepting an $29.9m (R334m) interest-free loan. The funds from the loan will cover Bokoni’s capital expenditure, operating and working capital expenses.

The loan replaces a earlier bid to forward C$42.4m (R484m) to Atlatsa last year until Amplats reversed its decision – a turn of events that placed huge questions over the sustainability of Bokoni Mines. A few months later, Amplats announced it intended to push for further cuts to Bokoni’s cost base. Atlatsa owns 51% of Bokoni Mines.

Then in December, Amplats said it had written off previous loans advanced to Atlatsa to the tune of R1.4bn and reiterated its interest in selling its stake in the company. In the event the Amplats stake is sold – which it said could be either in a single or a series of transactions – the $29.9m loan must be repaid.

Commenting on the divestment process, Atlatsa said it remained in discussions with Amplats and the Department of Mineral Resources (DMR), although it added: “A central theme surrounding these discussions remains the future sustainability of Bokoni Mine”.

Atlatsa was commenting following publication of its annual results for the 2015 financial year and fourth quarter operating figures. The decline in the dollar price of platinum group metals, and slightly lower production for the year, resulted in an attributable loss of $167.1m (2014: -$24.6m) equal to a share loss of 30 US cents (2014: -5 US cents).

In terms of its restructuring plan, Atlatsa has cut corporate expenses R1m a month and reduced Bokoni’s management fee to Atlatsa by 11%. However, most of the pain of the restructuring will be felt by full time employees and contractors.

As of December 31, mining employees had been reduced to 5,613 from 6,101, a reduction of 8%, consisting of an 13.4% decrease in contractors and an 4.3% decrease in ‘own mine employees’. Recognised unions agreed to the labour cuts following an agreement signed on February 8.

Said Atlatsa: “Mine management is currently engaged in a redeployment process post signature of the retrenchment agreement, after which, retrenchment of certain employees who cannot be redeployed could take place.

“The Restructure Plan targets a total labour complement of approximately 3,500 employees for Bokoni Mine”. It would be completed by the second quarter of this year, it said.

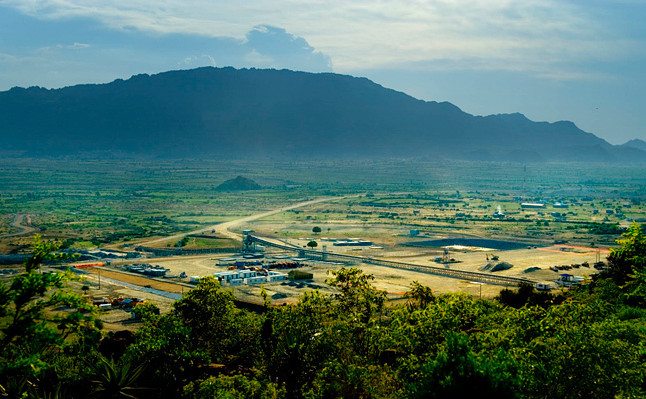

Following the restructure, Bokoni Mines will operate from two shaft complexes where previous it operated from four, and reduce its aggregate operating costs by moving to lower cost, new generation shaft operations. It would also access higher grade Merensky mining areas at its new Brakfontein shaft complex.

Bokoni Mines produces about 190,000 ounces of platinum group metals but its long-term plans have been to more than double production to about 240,000 oz/year from two main projects – Middelpunt Hill and Brakfontein Merensky underground projects.

It drafted in experienced mine manager Dawid Stander a couple of years ago to help it manage the process and extract the best from its existing ageing operations, including an open cut section. However, Stander’s contract has not been renewed. He was replaced by Jose Melembe as GM of Bokoni effective February 1.

“The Bokoni Mine remains an operation in development with its key Brakfontein Merensky and Middelpunt Hill UG2 underground development shafts remaining in their ramp-up phase and on target to achieve planned steady state production by Q4 2016 and 2019, respectively,” said Atlatsa in a statement.

“In a challenging economic environment for South African PGM producers, mine management continues to focus on various initiatives to improve operational efficiencies, disciplined capital allocation and cost management, without comprising Bokoni Mine’s existing ramp up plan,” it added.