EGYPT today set down the terms of a new mineral exploitation regime in which it will issue 30-year exploration licences to miners on condition the state receives 15% of net profits.

The agreement – known as the model mining exploitation agreement – also sets down a 5% government net smelter royalty on revenue and allows for a 22.5% corporate tax rate. An additional 0.5% community development contribution will be levied while holders of the exploitation licences must demonstrate local employment and procurement pratices.

Negotiated between mining companies and Egypt’s Ministry of Petroleum & Natural Resources, and the Egyptian Mineral Resources Authority, the MMEA will become effective once passed by Parliament towards year-end.

“The MMEA provides a clear regulatory and fiscal framework that fairly balances risk and reward between the stakeholders while providing a stable operating environment required by the international mining community and its investors,” said Martin Horgan, CEO of Centamin which operates the 400,000 to 500,000 ounce a year Sukari gold mine in Egypt.

The MMEA did not apply to Sukari which operates under the the Sukari Concession Agreement of 1994. In terms of this, Centamin equally shares the operating profits from Sukari with the Egyptian government.

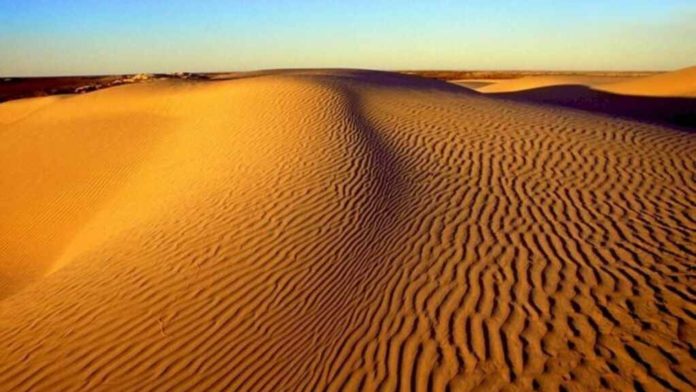

In March 2020, the Egyptian government put 56,000km2 of exploration concessions in the Eastern Desert region under the hammer as part of an effort to modernise its resources sector of which the MMEA is part and parcel.

The auctioned concessions attracted a number of interested parties including Barrick Gold which was awarded four exploration licenses for 19 blocks in 2021.