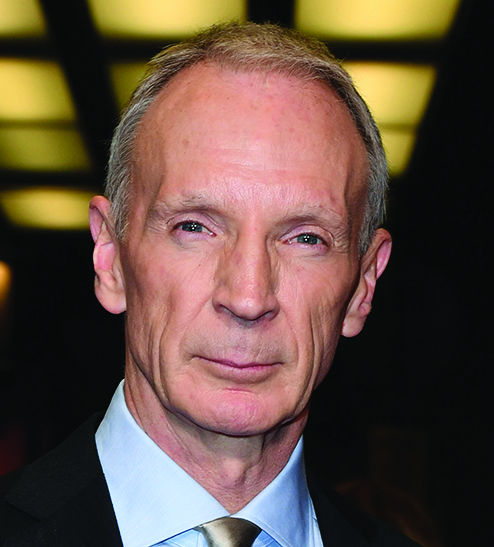

Clifford Elphick

CEO: Gem Diamonds

‘There have been some inappropriate sales out of Botswana that have impacted us’

GEM Diamonds struggled in 2024 with the share price going nowhere fast, despite Elphick achieving some success with cutting costs at the firm’s Lesotho mine, Letšeng. That was the only way of dealing with the continuing slump in the global diamond market. Gem’s performance looks good compared with other diamond juniors as it is insulated by the number of large, high-quality diamonds produced from Letšeng. These stones have generally held their value far better than the bulk of the industry’s output of lower-quality diamonds. But, for a true reflection of Gem’s overall performance, you need to keep in mind that the shares traded as high as £11 when it listed in 2009.

As of November last year Gem was trading around 11p/share. The reasons for that lie in expansion plans implemented by Elphick which didn’t pan out. All that is blood under the bridge because in 2024 Elphick’s sole operational focus was on sustaining production at Letšeng. A prefeasibility on an underground project at the mine’s satellite pipe was ditched in favour of a new cutback. Management concluded this was cheaper owing to a reduction in waste tons and less equipment use and with a minimal technical risk attached to the steeper slope. The downside is there was a loss of diamond-bearing tons.

Gem also won a renewal of its $30m revolving credit facility for another two years on slightly cheaper terms. Elphick is hoping for an improved market. One positive was Botswana President Duma Boko’s surprise victory, which could stop “inappropriate diamond trade” from the country that was undercutting his mine’s prices, Elphick said.

LIFE OF CLIFFORD

He is former Anglo American and De Beers ‘royalty’, being one of the chosen few who were fast-tracked in their careers at the group, where he held positions as Harry Oppenheimer’s personal assistant and then MD of the family business E Oppenheimer and Son. He left after the first of the major corporate shake-ups at De Beers with the stated objective of creating Gem Diamonds as an example of how a true diamond mining group should be run. It did not work out that way, with Elphick blowing $635m on acquiring of various mines around the world, all of which were subsequently shut down, leaving Gem with just Letšeng as an operating mine.