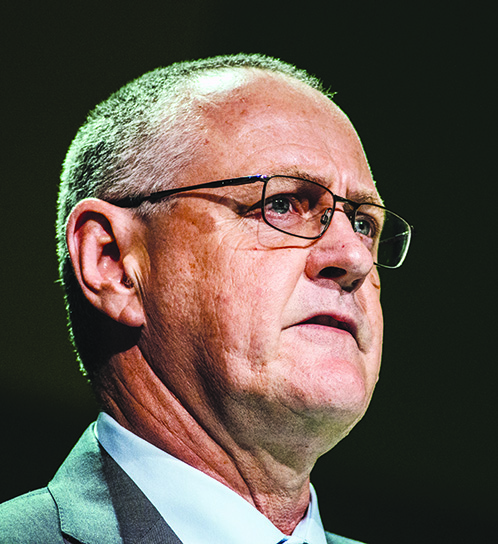

Ian Purdy

CEO: Paladin Energy

‘ We were probably a bit optimistic. We’ve still making really good money off the production we are getting’

IAN Purdy must have whiplash from 2024 with its multiple challenges. In January the uranium price surpassed $100 per pound for the first time in more than a decade, sparking excitement that it was finally the long-unloved commodity’s time to shine. That didn’t pan out and despite nuclear energy being touted as key to decarbonisation, uranium drifted lower over the year. Before enthusiasm for uranium waned, Paladin shares hit a 14-year high in the first half of the year.

The second half of 2024 proved to be more challenging for Purdy and his team. In June, Paladin announced the C$1.14bn scrip acquisition of Canada’s Fission Uranium Corp. However, Fission postponed a shareholder vote in September due to lukewarm support, though the extra time allowed it to get more investors over the line. Paladin then warned in November that there was no certainty the deal would close after delays in obtaining Canadian regulatory approval. It was eventually given in mid-December enabling Purdy to finalise the takeover on December 24. Before year-end, Paladin announced trading of its shares in Toronto.

Purdy’s worries also extended to its Langer Heinrich Mine in Namibia. Paladin shares plunged in November when the company reported “ongoing challenges and operational variability” during the ramp-up. It revised its production guidance for the 12 months to June 30, 2025 down to 3-3.6Mlb from 4-4.5Mlb and warned of a material impact on operating costs. The confident and capable Purdy will be hoping for a much smoother run in 2025.

LIFE OF IAN

Ian Purdy is a chartered accountant but has spent his entire career – spanning more than three decades – in the resources sector. His previous positions include senior roles at WMC, and Norilsk Nickel Australia where he was MD. He was CEO of Mirabela Nickel, and most recently CFO of Quadrant Energy. He joined Paladin in February 2020 and has overseen major share price growth in that period.