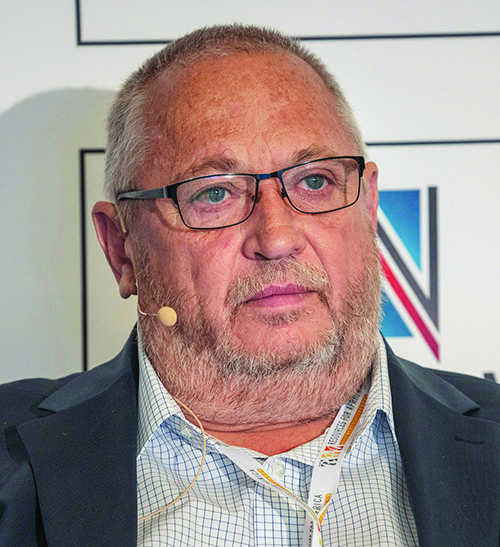

Daniel Major

CEO: GoviEx Uranium

‘We are fully prepared to pursue all necessary legal avenues to defend our rights’

IT was the nightmare scenario Daniel Major and his GoviEx shareholders feared the most. In July 2024, the military junta that had ruled Niger since the previous July, withdrew a mining permit to the Toronto-listed firm’s flagship $343m uranium project, Madaouela. Just like that, more than 15 years of work was rubbed out. The government’s decision, based on its controversial view that GoviEx had dragged its heels developing the mine, came amid a market highly encouraging of new uranium oxide supply, and just as the company was lining up an initial $200m in project finance. GoviEx quickly shifted its attention to Muntanga, a project 200km south of Lusaka in Zambia.

A feasibility study for Muntanga is being fast-tracked while additional exploration properties are being added ahead of first production, which is forecast to be two years after financing. The project is smaller than Madaouela; nonetheless, it has an estimated 10.9 million pounds of inferred resources in uranium oxide. “Adversity often paves the way for reflection and re-evaluation,” said Govind Friedland, the company’s chairperson. In a far less reflective mood, GoviEx also said it was “fully prepared to pursue all necessary legal avenues to defend our rights” – a clear sign to Niger a damages claim is in the post.

Sure enough, arbitration proceedings under the Convention on the Settlement of Investment Disputes Between States and Nationals of Other States was initiated in early December. Broadly, these events pose big questions about the agenda of countries like Niger in the Sahel that are in thrall to Russia.

LIFE OF DANIEL

Major studied at the Camborne School of Mines in Cornwall, once the capital of the UK’s mining industry. In his 30 years in mining, he’s worked at Rio Tinto’s Rössing uranium mine in Namibia and for Anglo American Platinum in South Africa. He then dipped out of the operational side of things and took up a role as a mining analyst with HSBC and then subsequently JPMorgan Chase. Since then, he’s held several roles in Russia, Canada and South America, and has been with GoviEx since 2012.