SHAREHOLDERS in Harmony Gold came to the party this week buying shares worth R3.47bn – about $200m – enough to provide the South African gold producer with cash to complete the purchase of assets from AngloGold Ashanti.

With a narrow discount of just 3.5% to the trading price of the previous 30 days, Harmony placed 60.28-million shares, slightly more than one tenth of its shares in issue, to raise the cash to pay AngloGold, said BusinessLive. The placement price was R57.50 per share.

The Mponeng deal would include a further $100m coming from a $260/oz of gold mines from Mponeng and the other two mines included in the transaction when output topped 250,000oz a year over a six-year period starting from 2021.

Harmony will pay a further $20/oz on gold output coming from any extensions of mining below existing infrastructure at Mponeng, Savuka and TauTona.

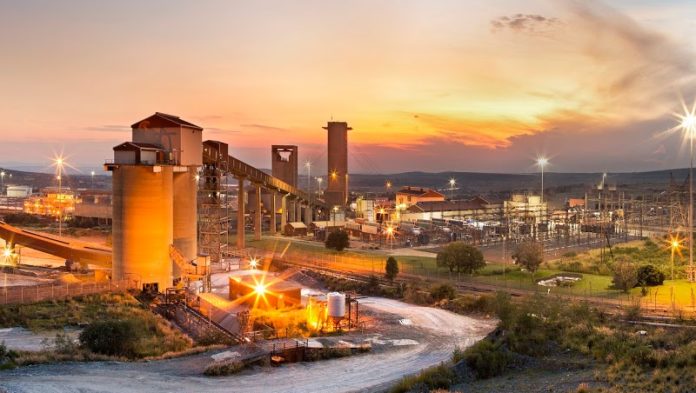

The only outstanding condition needed was the approval from the Department of Mineral Resources and Energy for the transfer of mining rights from AngloGold. Harmony is buying AngloGold’s Mponeng and Mine Waste Solutions (MWS).

“We intend replicating our success in South Africa, with decades of acquiring, operating, and extending the life of mines, and extracting additional value from mining operations,” said Harmony CEO, Peter Steenkamp, in a statement.

Steenkamp told BusinessLive in an earlier interview one of the most immediate value creators was merging the tailings that came with its $300m Moab Khotsong and Great Noligwa mine purchase from AngloGold in 2018 into the MWS.