SOUTH Africa has opened discussions with the World Bank over a $1bn loan to help upgrade power and logistics infrastructure, said BusinessLive.

The “discussions about discussions” were preliminary but aimed at recapitalising Eskom and Transnet as the South African fiscus no longer had the financial headroom, the newspaper said in a report today.

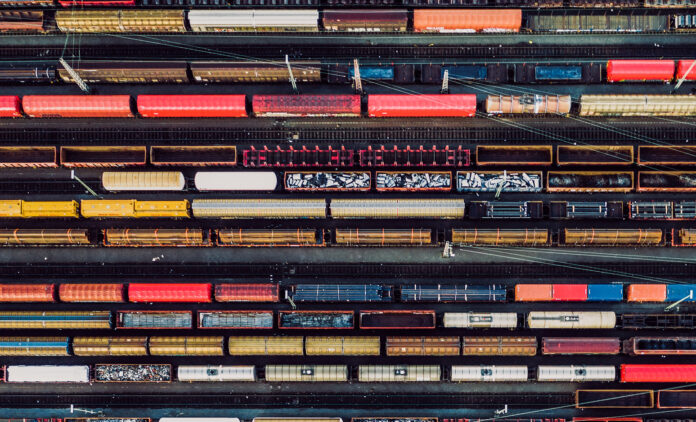

“It’s exploratory discussions about our pain points, as South Africa, on the capital requirements to get our network industries going,” deputy finance minister David Masondo said. “For Transnet to invest in its freight rail infrastructure and port infrastructure they need money and unfortunately the fiscus does not have that money.”

Eskom was allocated R254bn in February to service its debts to global financial institutions, which currently top R423bn. The National Treasury paid the first tranche of R16bn at the end of July, while the next tranche is expected at the end of October, said BusinessLive.

In the 2022 medium-term budget policy statement Transnet was allocated R5.8bn by the Treasury to fund the repair of infrastructure damaged by the floods in KwaZulu-Natal and the Eastern Cape, and to maintain freight rail locomotives. Transnet’s 2022/23 financial results show that it is sitting on R130bn in debt, serviced at a cost of R1bn a month.

BusinessLive has previously reported that Transnet was in talks with the Brics-backed New Development Bank for an R18bn loan to upgrade its locomotives.

The success of the discussions would turn on how the loan was utilised, Masondo told BusinessLive. He said: “Debt in itself is not a problem as long as the country is able to afford to service the debt … if the economy grows enough to service the debt then the debt is not a challenge”.

:If it’s debt to bail out ailing SOEs then that debt is problematic. If we are accumulating debt to sort out electricity and transmission and rail infrastructure, then that debt is productive and builds value as it builds our capacity as a country to grow the economy.

“We do have capacity to generate more debt; the question is what is that debt used for.”