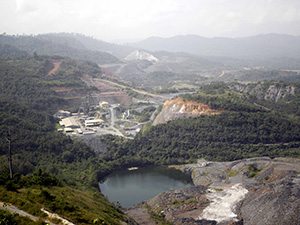

[miningmx.com] – RANDGOLD Resources, the UK-listed gold company was “still scrambling” at Obuasi, the Ghana mine in which it may invest in joint venture with its current owner, AngloGold Ashanti.

“It’s totally uncallable at the moment,” said Mark Bristow, CEO of Randgold. “We have still got some very heavy lifting to do to see if it gets through our [investment] filters”.

In September, Randgold and AngloGold jointly announced details of a proposal in which the two firms may contribute equally to the mine’s recapitalisation which would total some $600m in capital and $400m in sustaining capital.

The key target dates are that Randgold complete the due diligence and development plan for Obuasi by the end of January and that the regulatory terms are agreed with the Ghanaian government and ratified in parliament by end-March 2016.

Bristow said it was also necessary that the Ghanaian government “come to the party” by offering a stability agreement.

“There has to be a clear stability agreement with clear rules of engagement We need this before we can bring in fresh capital, especially into a country that does not have a track-record of making money from its mining,” he said.

If approved, Obuasi would be the third joint venture to be set up between Randgold Resources and AngloGold with the first two being Morila in 2000 followed by Kibali, the mine in the Democratic Republic of Congo.

Randgold said in its third quarter operating and financial figures today that Kibali was on track to beat guided production of 600,000 ounces for the financial year. It was a high point of generally disappointing production numbers from Randgold.

Gold production for the quarter was 305 288 oz, up about 5,000 oz over the previous quarter, but heavy rains in Mali resulted in lower-than-forecast grades and production, impacting on total cash cost per ounce, which rose to $699/oz from $684/oz.

A further drop in the gold price also depressed profits, which were $48.8m against the previous quarter’s $59.2m, the company said. However, the group increased net cash to $168m as it edged towards a five-year target of $500m net cash.

“The issues at Mali were unexpected and as such we expect the stock to under-perform today, especially on the back of a lower gold price,” said Goldman Sachs.

Bristow said, however, that despite the setbacks in Mali, the company’s production guidance would not be threatened. “Kibali will do 5% better, maybe more, so we’re fine on our overall guidance,” he said.

“We are open to the gold market pressures like the rest of the industry, and our margins are beginning to tighten, but we are still making a profit when everyone else is making a loss,” he said.