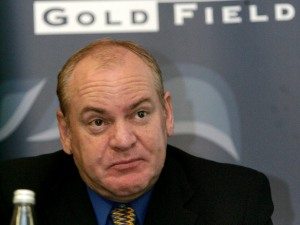

[miningmx.com] – NICK Holland, CEO of Gold Fields since May 2008, declared himself the right person to take the group forward, and said the firm’s South Deep mine would break-even by the 2014 financial year.

“I wouldn’t be sitting here if I didn’t want to carry on,’ Holland said when asked if he had the appetite to continue running the company.

Bloomberg News, citing Charl Malan, an analyst for Van Eck Associates in New York, said in a report on November 19: “The pressure has been on Holland for a long time. Do I think he has generated returns for shareholders? At this time, no, he has not’, adding that some of the factors for the under-performance were not in Holland’s control.

Malan said that CEOs who did not perform ought to “move on’, as evidenced by the large number of executive departures in the mining sector in the last 12 months.

“You want this?,’ Miningmx asked Holland of his role as CEO. “Yes, I do,’ he replied.

Much of Holland’s future turns on the performance of South Deep. Given that Holland has dug in despite another setback in the Johannesburg mine’s expected 700,000 oz/year production target, however, it seems that operational fortunes are not likely to be the defining factor influencing his tenure, at least, not immediately.

More likely is the outcome of the Securities Exchange Commission’s (SEC) inquiry into the mine’s R2.1bn black economic empowerment deal, a transaction that has attracted a fair share of bad publicity for Holland and Gold Fields. The company acknowledged the SEC intended to probe the deal on September 10, but has said little else, and today stone-walled questions.

“We are not going to accept any questions on the SEC investigation,’ Sven Lunsche, Gold Fields spokesperson told media who had gathered at Gold Fields’ Sandton headquarters for a roundtable discussion on the group’s September quarter results. “Any questions will be met with a stoney silence and I will ask to move on,’ he said.

South Deep

Although South Deep is moving in the right direction – its September quarter annualised production is 327,000 oz – Gold Fields is to review the likelihood of it meeting 700,000 oz by 2016. Based on the fact that 15% growth in tonnes a year was a base case scenario, this would mean the mine would only achieve target in the 2018 financial year.

Holland wouldn’t commit to the possibility of the group deciding not to chase down 700,000 oz, already some 50,000 oz down on targets set by previous owners, including Gold Fields itself. “I’m convinced that 330,000 tonnes/month of ore is do-able which underpins the 700,000 oz situation,’ said Holland. He acknowledged the group wasn’t married to 700,000 oz, however.

More details on production targets will be made available in February, suffice to quote Holland: “South Deep is a bulk story and economies of scale come into the equation. We now have a lot more empirical information and we will feed that into our assessment,’ he said. He pointed to the “leveraging effect’ of South Deep quarter-on-quarter in which it produced some 4,000 more ounces of gold but lowered All-In Costs by $300/oz to $1,446/oz.

On average Gold Fields is producing gold at $1,300/oz or better on an All-In Sustaining Cost basis. This is equal to a 15% free-cash flow margin that would make it break-even at a gold price of $1,100/oz.

Given that this helped the group to a third (September) quarter profit, there is the growing possibility of it producing some kind of return to shareholders. Said CFO, Paul Schmidt: “We have not suspended the dividend policy; we are applying the policy which is 25% of normalised earnings (excluding non-cash impairments)’.

“We made earnings this quarter, and if make earnings next quarter, we can expect a dividend,’ Holland added.

Nor is the balance sheet a concern, said Schmidt. Net debt has ballooned to $1.6bn from $1.2bn in Gold Fields’ restated December’s net debt figures (allowing for Sibanye Gold), but this was still 1.5x pre-tax earnings against bank covenants which will only be broken at 2.5 pre-tax earnings, said Schmidt. (Prior to strike action, Gold Fields debt was at 0.5x).

Schmidt said the increase in net debt was understandable given the R2.5bn outflow from last year’s strike and a $300/oz reverse in the gold price. “The big aim in the next two to three years is to bring down the debt situation without having to do a financing,’ said Schmidt.