GOLD ended 2022 pretty much where it started, at about $1,800/oz. That may look a pedestrian performance but compared to other asset classes gold did exactly what gold ought to do: preserve wealth.

Set gold’s performance against crypto – asset classes described as rivals. Towards to close of December, Bitcoin was about 63,65% weaker – a performance less to do with the demise of Sam Bankman-Fried’s FTX exchange, and more to do with a fundamental shift in the financial market this year. With rates increases, the period of so-called ‘easy money’ has been replaced by an environment of much tighter liquidity.

Goldman Sachs pointed out in December that in these altered conditions, gold is supported by physical demand which makes it a better portfolio diversifier than Bitcoin could ever be. In contrast, Bitcoin is shown to be correlated to its future value, not its present. As an asset class Bitcoin thrives on volatility whereas gold offers stability. “As such, we believe gold’s low correlation with financial conditions means that it will be a useful portfolio diversifier,” said the US bank in its report.

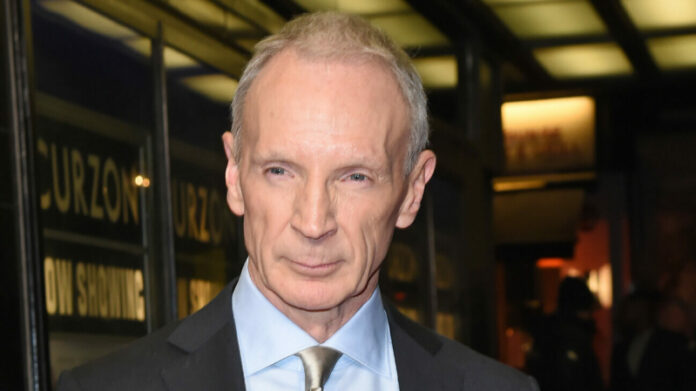

But what if gold was able to retain its preservation characteristics, and become easier to trade? That’s the challenge former UBS banker David Tait set himself on becoming the World Gold Council’s CEO about two years ago. He believes that in combining gold’s revered wealth preservation characteristics with modern ease of trade it will become more attractive to institutions. They may, he believes, seek to risk weight gold differently with potentially enormous benefits for the metal.

“I can’t put a timeline on it, but I would anticipate seeing real change between three to five years from now. I really would,” said Tait of his plans for gold captured in the World Gold Council’s marketing strategy launched in October called Gold 247. That plan is quite simply to make gold easier to trade for large banks. For this to happen, a number of things need to happen. Firstly, a database of gold supply has to be established making gold’s provenance unimpeachably uniform. Secondly, a tradeable ‘unit’ of gold has to be created giving gold a fungibility it doesn’t currently possess.

Tait is not a gold industry aficionado; in fact, he characterises himself as something of a slightly puzzled outsider. What’s all this business with gold products, weights and purities that comes with refined gold, he seems to ask? And why does gold spend so much time on a plane with all its attendant security risks, and why does it take more than a working week to settle gold trades between institutions?

In this regard, Tait describes gold as ‘capital heavy’ whereas the currency market is ‘capital light’. In layman’s language, gold comes with too much baggage; it’s like the nightmare airport passenger stuck at check-in, the one who didn’t follow the rules of travel.

“If you think of that and you imagine solving for that problem which is our objective, we are trying to encourage all asset managers to think of gold in a 5% or 10% bucket of any portfolio,” says Tait. “That’s what my goal is.”