REPORTS in Papua New Guinea (PNG) say Harmony Gold will soon get its greatly desired, much delayed special lease to mine the country’s Wafi-Golpu deposit by November. “I met with the developers recently and we agreed upon this schedule,” Luther Wenge, governor of PNG’s Morobe, told reporters.

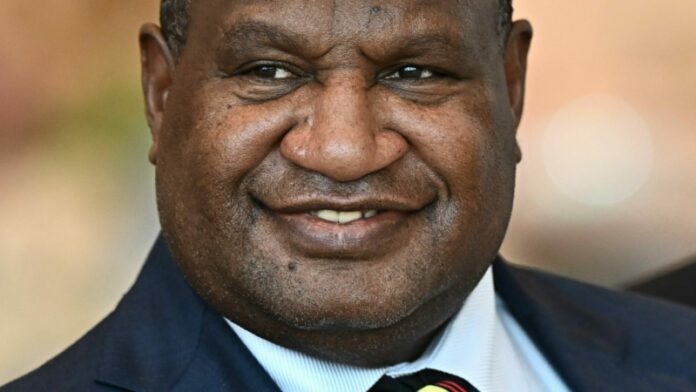

This is more than Harmony is letting on, though the market should know something is up as the company dispatched executive chair Patrice Motsepe to the Oceanic nation last month. Motsepe is a jet-setting glad-hander of note, but this was no ordinary rendezvous, as he was pictured meeting PNG prime minister James Marape.

In fact, Motsepe is but a minor figure in the pantheon of dignitaries to have lately set foot on PNG. According to The Economist everyone in the West wants to be on good terms with Marape after PNG neighbour Solomon Islands signed a defence treaty with China. According to the newspaper PNG has “again become a geopolitical prize, this time in the contest between America and China, not to mention its gas, copper and gold resources”.

US President Joe Biden was forced to call off a personal visit, but he sent lieutenant Antony Blinken, American secretary of state, who signed a defence co-operation agreement with PNG. This trip was followed by a visit from US defence secretary Lloyd Austin. Other recent visitors to PNG include Prime Minister Narendra Modi of India and President Joko Widodo of Indonesia.

But the American visit is most resonant and consequential for Harmony. Denver-based gold giant Newmont is set to become Harmony’s new partner in Wafi-Golpu once it completes the $19.5bn takeover of Newcrest — Harmony’s current 50/50 partner in Wafi-Golpu.

Having a US partner in an asset which also produces significant volumes of copper — a mineral favoured by the Biden administration for its role in decarbonisation — is handy, and explains why the licensing of Wafi-Golpu is suddenly accelerating. It’s worth noting that Wafi-Golpu has been trapped in red tape for the best part of a decade.

Harmony declined to comment on the ramifications of having a US partner, but spokesperson Jared Coetzer said the position of Wafi-Golpu was “complex”. There are a lot of “coincidental” things happening, though. “It does seem very calculated.”

Why this matters for investors especially is that Harmony has given itself until the end of the calendar year to decide how it might apply capital to the deepening of its Mponeng mine in South Africa. The project could sap billions of rand that may be better applied in PNG.

While it’s questionable to say that the country has a better political risk profile than South Africa, it has copper and a powerful, strategically positioned funding partner. In comparison, Mponeng is deep and labour intensive.

It’s also difficult to allocate capital when the trajectory of power supply is difficult to plot. So there are some weighty choices ahead for Harmony. Not least because Wafi-Golpu is a monster to finance. In terms of a 2018 feasibility study, $5,38bn is required in development capital alone.